ASEAN: Brace for impact when risks materialize

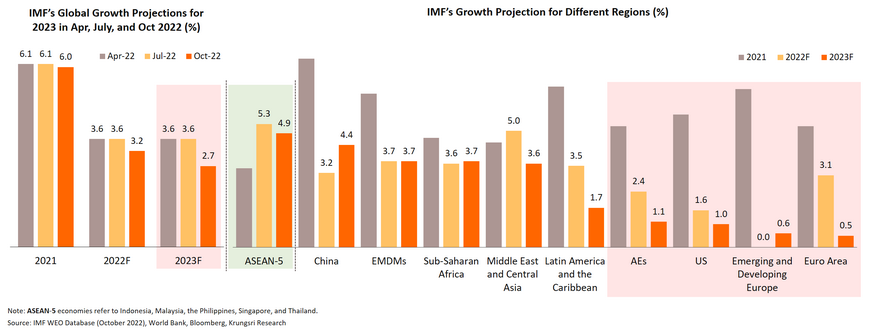

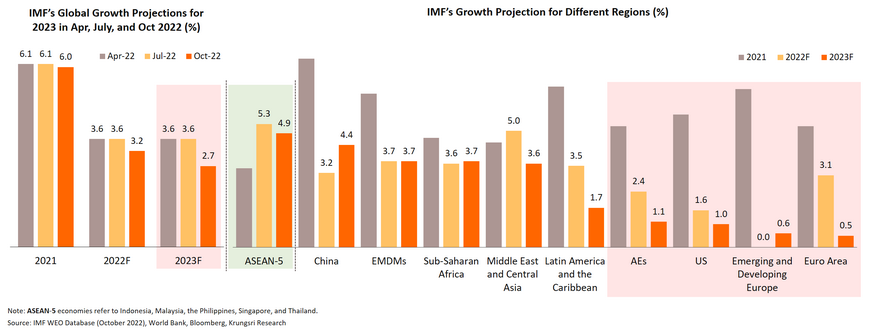

- ASEAN countries will experience slower growth in 2023, at 4.9% compared to 5.3% in 2022, as risks have started to materialize compounded by stronger internal and external headwinds. Inflationary pressure remains elevated amid tighter financial conditions. External demand is weakening against the backdrop of a deteriorating global economy, aggressive monetary tightening in advanced economies, and repercussions of the lingering conflict between Russia and Ukraine. However, the bloc remains the fastest-growing region.

- Growth will hold up well in Vietnam, the Philippines, and Indonesia, driven by domestic demand, particularly private consumption, and the recovery of international tourism. Other tailwinds are free trade agreements including the RCEP, and FDI inflows boosted by diversification efforts of MNCs.

- Policy priorities will be pivoted to preserve macroeconomic stability amid weakening external demand and fiscal consolidation to reduce debts.

- Risks to the outlook are tilted to the downside. Common threats to the region’s growth trajectory are (1) weaker-than-expected global output, (2) more-aggressive-than-expected monetary tightening in the US, (3) sharper-than-expected slowdown in China, and (4) a deeper global energy crisis.

- Lao PDR continues to face high probability of external debt distress and an economic crisis.

- Cambodia and Myanmar will hold general elections in 2H 2023 but we do not expect a significant shift in power.

Growth across ASEAN will slow compounded by several headwinds; policy priorities have shifted to maintaining stability

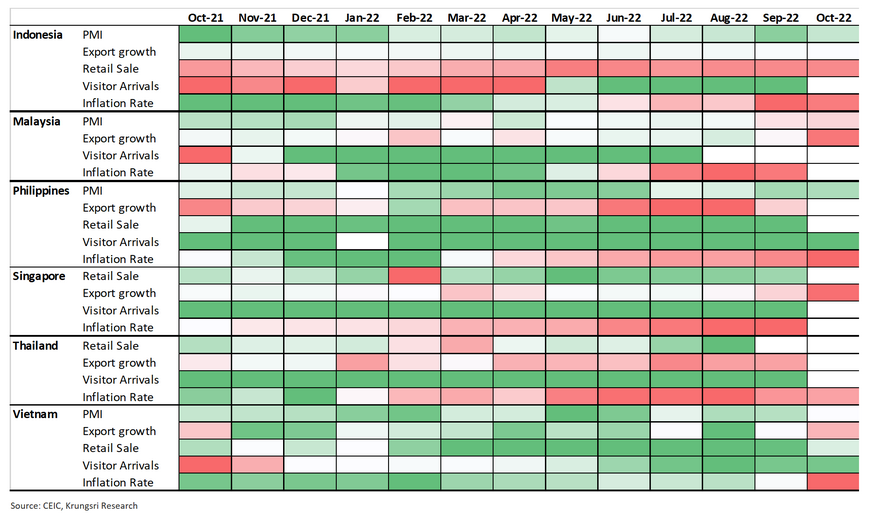

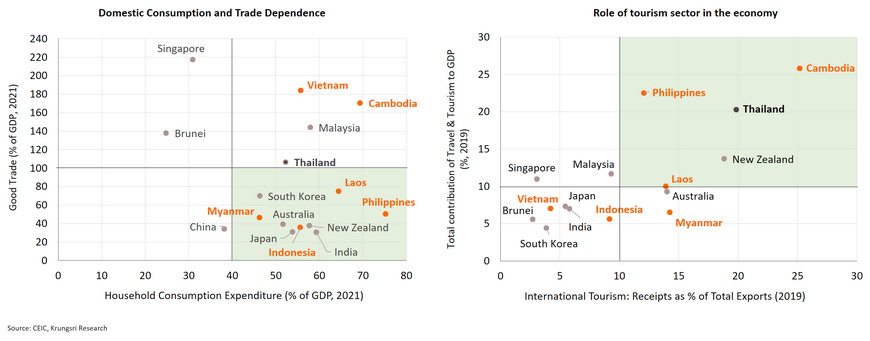

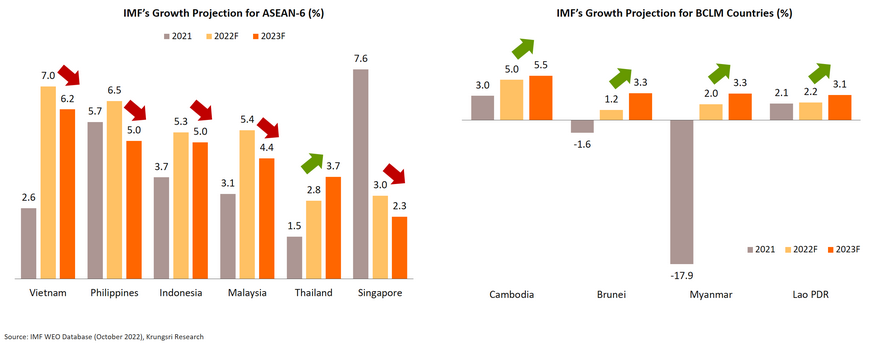

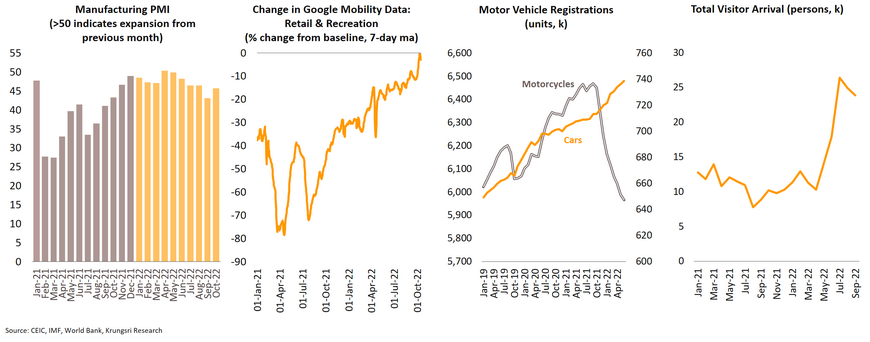

ASEAN region will experience slower growth in 2023 due to internal and external headwinds amid a worsening global outlook. According to the IMF’s latest projections (October 2022), growth in ASEAN-5 countries will reach only 4.9% in 2023 vs 5.3% in 2022. However, ASEAN will remain the fastest-growing region in 2023. Against the backdrop of a deteriorating global environment, risks and challenges are imminent. These include (1) deteriorating growth in advanced economies (AEs), especially the US, Europe, and China, (2) more-aggressive-than-expected monetary tightening in the US, (3) shaper-than-expected slowdown in China, and (4) a deeper global energy crisis. China will likely reopen borders and relax its Zero-COVID policy, but the timing and pace remain uncertain. Cambodia and Vietnam have larger exposure to external headwinds and risks than their ASEAN peers due to their high dependence on trade and export-driven growth. Hence, macroeconomic policy priorities across the region have shifted to preserving stability.

Despite headwinds and downside risks, growth is expected to hold up in Vietnam, the Philippines, and Indonesia

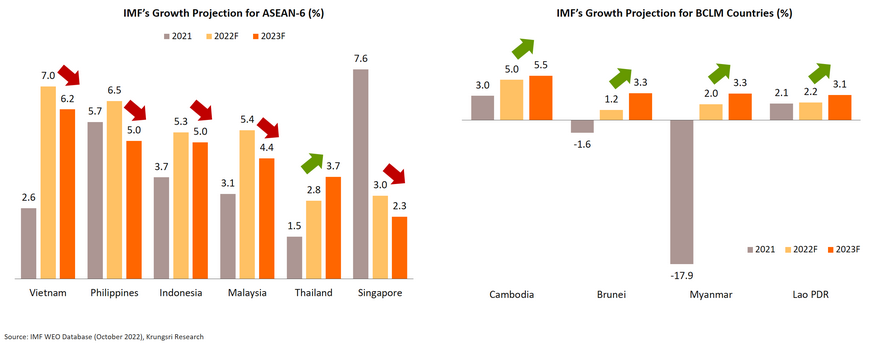

Despite strong external headwinds in 2023, we expect growth in Vietnam, the Philippines, and Indonesia to hold up relatively well that that of peers. In Vietnam, growth will slow to about 6.0% from 7.0% in 2022. In the Philippines and Indonesia, their economies will expand by 5.0%. Growth in the BCLM countries will be moderate. Domestic demand, especially private consumption, and tourism will be key growth drivers across the region amid a declining external demand and darkening prospects for the global economy. Looking ahead, risks and headwinds to growth are getting stronger. The common key risks for ASEAN countries are tightening global financial conditions and disruptions in financial markets, sharper-than-expected slowdown in China, lingering inflationary pressures, and elevated food and energy prices.

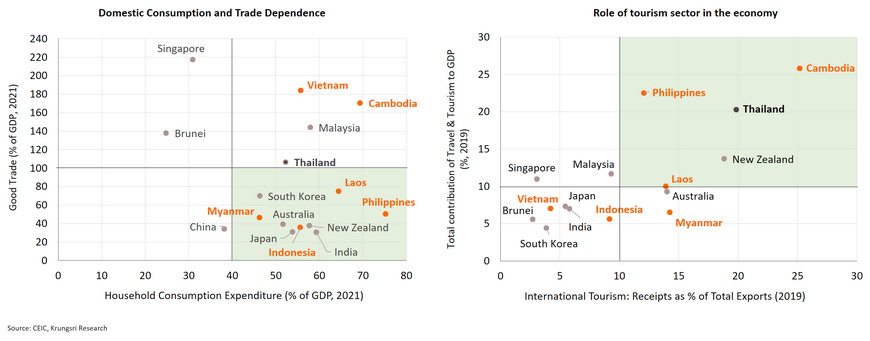

Domestic demand is resilient but weakening external demand will dampen prospects in 2023, especially in countries with strong dependence on trade

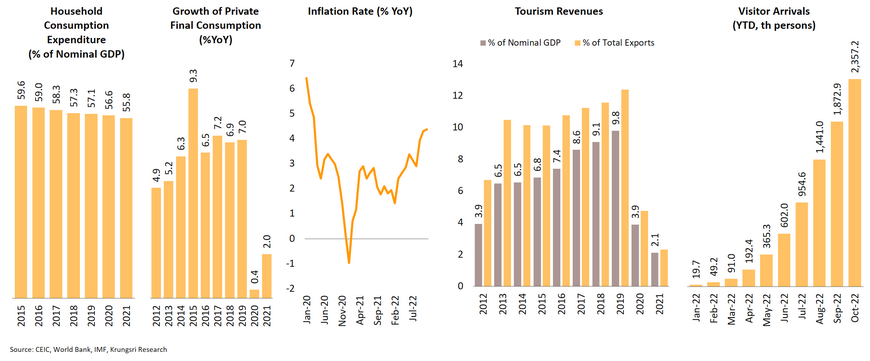

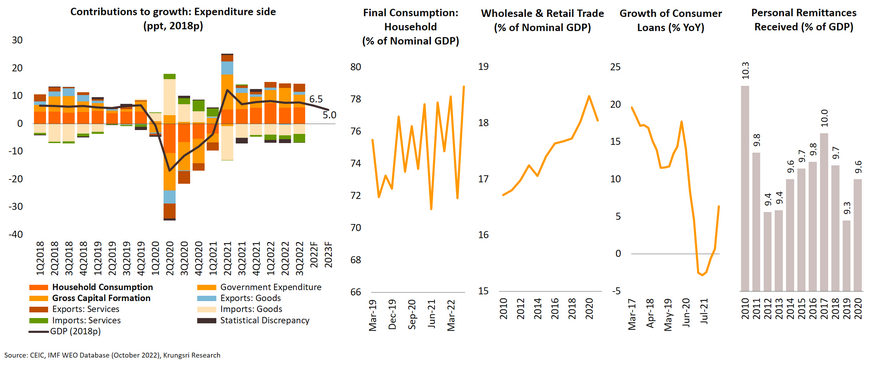

Sizeable share of private consumption and recovery of cross-border tourism will be key growth drivers

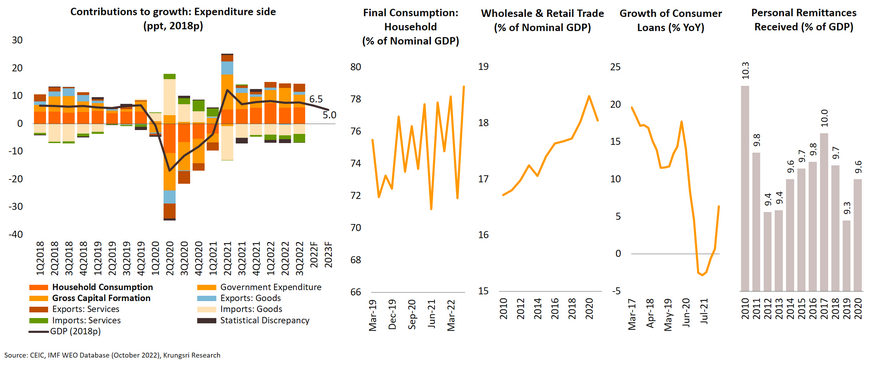

In 2023, household consumption and tourism will play key roles in cushioning growth in ASEAN amid a dimmer external outlook that could lead to a sharp slowdown in external demand. Countries with less dependence on trade and a large share of household consumption (% of GDP) like the Philippines (75%) Indonesia (56%), Lao PDR (64%) and Myanmar (46%) will withstand external headwinds relatively better than regional peers. Sizeable inflows of personal remittances will also support private consumption in countries like Cambodia and the Philippines where in 2020, the share of personal remittances reached 5% and 10% of GDP, respectively. The recovery of international travel will also boost growth and domestic activity as consumers worldwide shift from consumption of goods to services in the post-pandemic era. All ASEAN economies will benefit from this trend, particularly Cambodia, the Philippines, as well as Thailand.

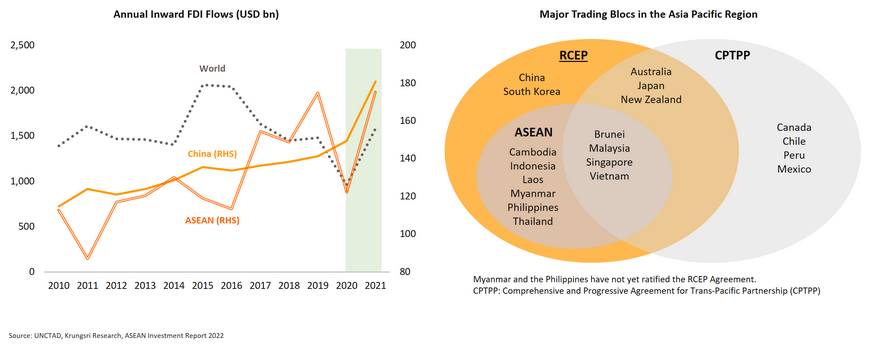

Inward FDI and free trade agreements will also support growth in 2023

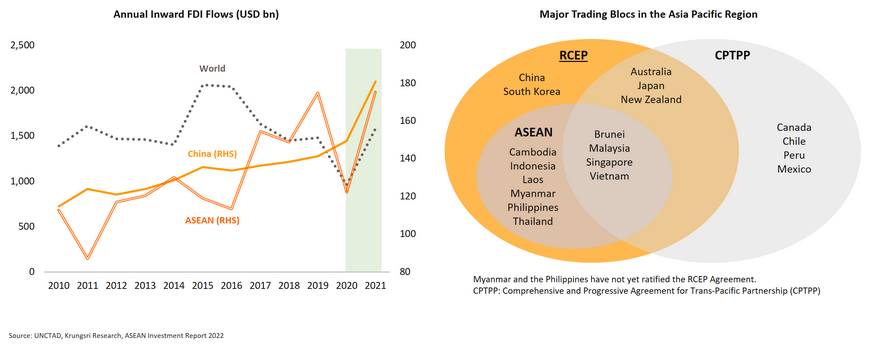

Intra-regional trade and FDI will remain major tailwinds to drive growth in ASEAN countries in 2023. The Regional Comprehensive Economic Partnership (RCEP), signed in 2020 and subsequently ratified by most members in 2022, is becoming the world’s largest economic bloc and should continue to boost both exports and FDI. Based on the ASEAN Investment Report 2022, in 2021, Southeast Asia was among the top recipients of FDI among developing regions after China. The region’s share of global FDI inflows had increased from a pre-pandemic annual average of 7% in 2011–2017 to 11% in 2018–2019 and to 12% in 2020–2021. The strong rebound in manufacturing, diversification efforts of MNCs in the post-pandemic recovery period, and investment in infrastructure-related activities, including in the digital economy, are among the key drivers of FDI inflows.

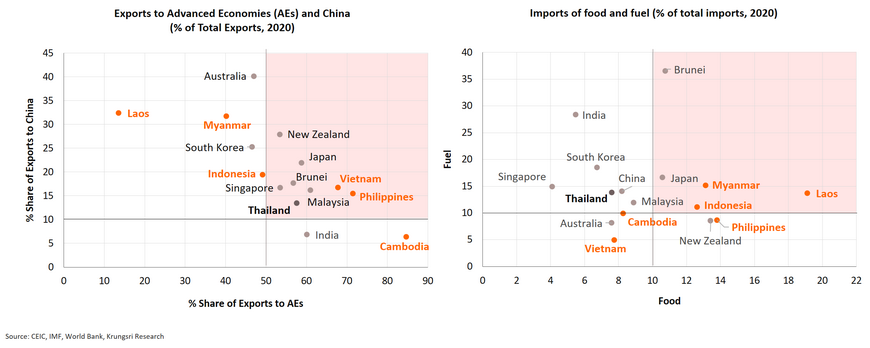

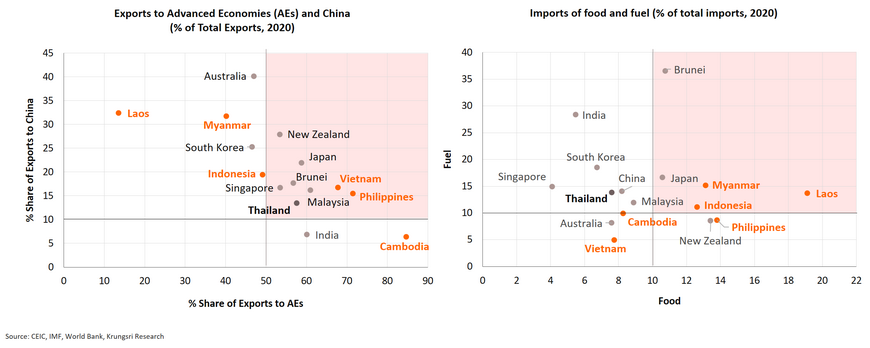

High dependence on exports to advanced economies (AEs) and China will cap growth prospects of countries in the region amid elevated commodity prices

Growth in major advanced economies, particularly the US and the EU, will slow sharply due to tighter financial conditions and inflation heightened by the extended conflict between Russia and Ukraine and geopolitics. This could have severe impact on exports in countries with a high dependence on AE markets. Vietnam, Cambodia, and the Philippines are among the top on the list. Exports to China would be limited by its Zero-COVID policy; this should impact countries like Laos, Myanmar, and Indonesia which the share of exports to China is relatively higher than peers. In addition, due to substantial dependence on food and commodity imports, elevated prices of those products - worsened by a weaker currency – could hurt domestic demand as well as threaten external sector stability of some countries.

Tighter financial conditions and the energy crisis amid a worsening global economic outlook will be among key risks to growth and stability in ASEAN countries

Looking into 2023, inflationary pressure could persist in countries like Indonesia, the Philippines, Lao PDR, and Myanmar. While policymakers in ASEAN are expected to pursue fiscal consolidation to reduce public debt level, they will shift monetary policies to maintain price stability. This could lead to tighter financial conditions, which would hurt domestic demand, particularly through higher funding and borrowing costs. Tighter global financial conditions and the appreciation of the USD could be disruptive for countries running twin deficits and that demand large external financing needs. Countries which have a sizeable external debt or rely on cross-border funding could be pressured by repayments of USD-denominated debts or difficulty in rolling over debt because of surging borrowing costs, which would lead to external debt distress.

Cambodia: Revitalizing key growth engines to support growth amid stronger external headwinds and emerging vulnerabilities

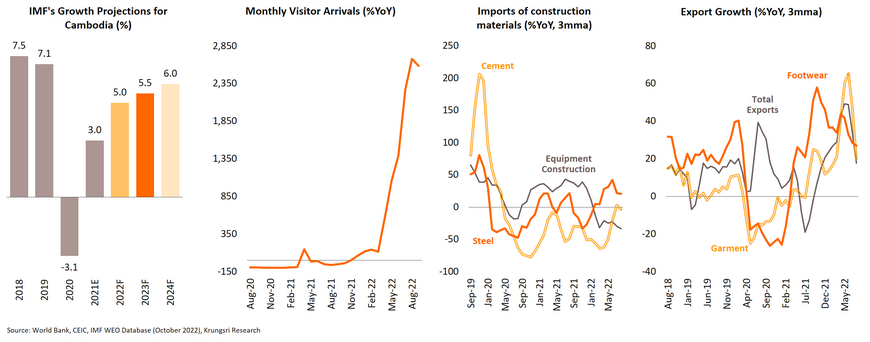

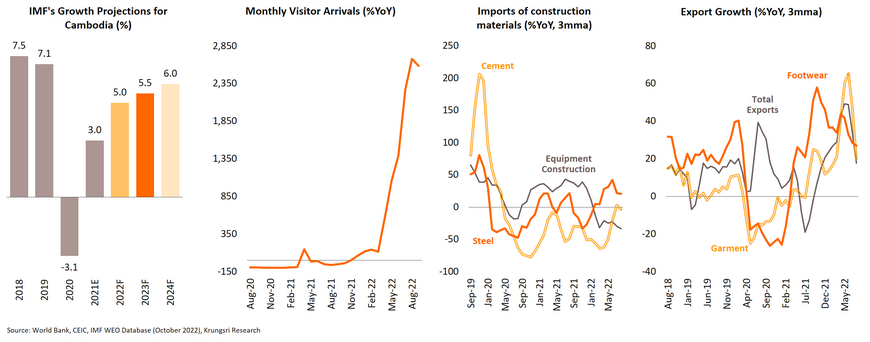

Cambodia’s real GDP growth is projected to reach 5.5% in 2023 following 5.0% growth in 2022. Growth drivers would be stronger domestic economic activity including construction and real estate, the continued recovery of international travel with policy support, and free trade agreements which would boost investment and trade. However, there are still strong headwinds to growth and risks are tilted to the downside. Financial stability remains fragile given persistent high credit growth and the concentration of domestic credit in the construction and real estate sectors. In addition, there is more external borrowing to finance domestic loan growth, especially in microfinance institutions, amid tighter global financial conditions. This could lead to concerns over repayment ability.

Resilient household consumption and recovering tourism will cushion the impact of slower external demand on growth

Sizeable household consumption (70% of GDP in 2021) and recovering tourism activity will play key roles to cushion Cambodia’s growth in 2023. The recent surge in imports has been driven by consumer and capital goods, which reflects a pickup in domestic demand. In addition, bank loan growth remains strong, which will be a boon to both domestic consumption and investment activities. Receding inflationary pressures will allow private consumption to rebound. In 2023, assuming the gradual relaxation of China’s Zero COVID policy, the tourism sector will continue to recover (Chinese tourists account for a third of total tourist arrivals in the pre-pandemic period). In the first 10 months of 2022, the country received more than 1.57 million visitors, and the Ministry of Tourism expects to receive up to 2 million international tourists in 2022.

Macroeconomic stability will remain vulnerable to external shocks amid external uncertainties and headwinds

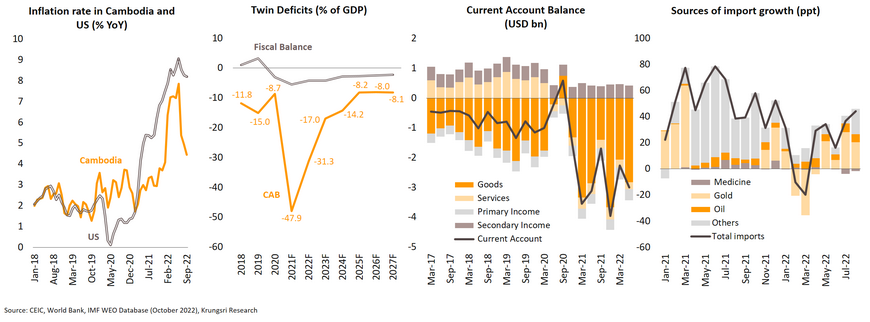

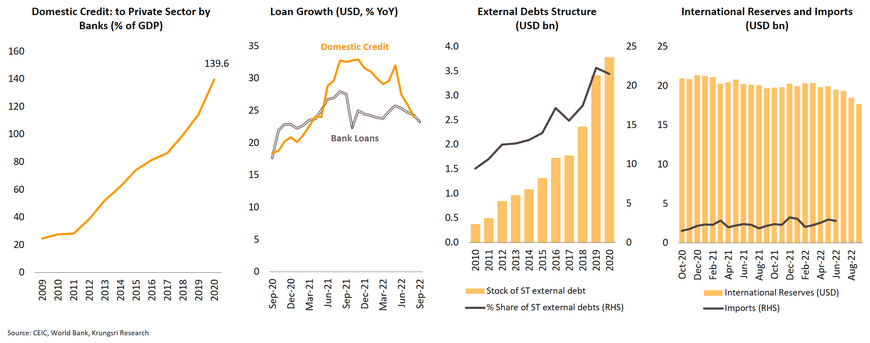

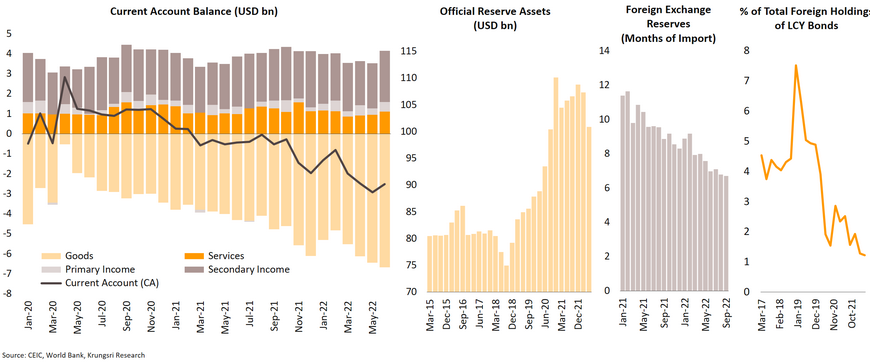

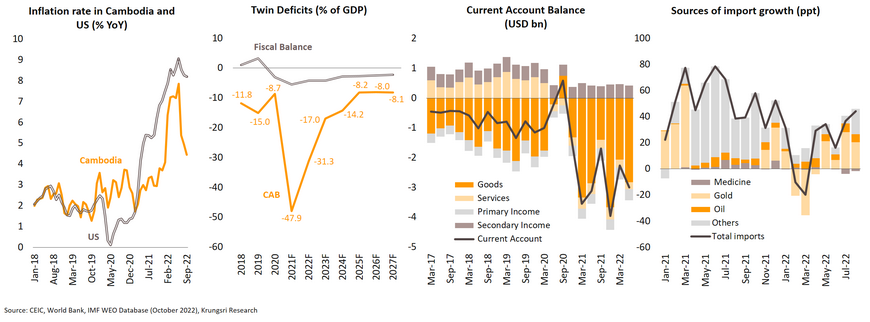

In 2023, Cambodia’s macroeconomic stability remain vulnerable to external shocks. On price stability, inflationary pressure in Cambodia seem to be easing after peaking in the first quarter of 2022 in tandem with inflation trends in the US. As Cambodia is a highly-dollarized economy, its price stability is explicitly influenced by the US Federal Reserve’s decisions. On the external front, there is persistent vulnerability. Cambodia faced a record current account deficit at 47.9% of GDP in 2021, according to the IMF. As the economy continues to recover, the large imbalance has been driven by trade deficits in both goods and services, with a large share of deficit caused by imports of gold, which should be transitory. However, in 2023, in the absence of a full recovery of the tourism sector coupled with a deteriorating global economy, current account imbalance will remain severe. The current account deficit should narrow along with a recovering tourism sector and the rebound in FDI inflows over the medium term, but the country could face challenges in terms of external financing in the near term.

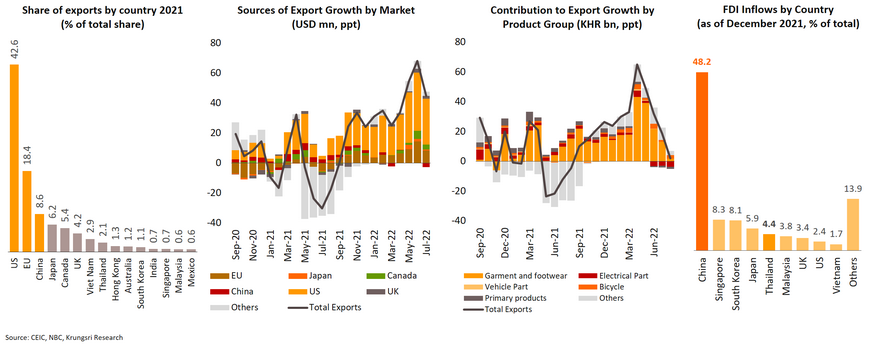

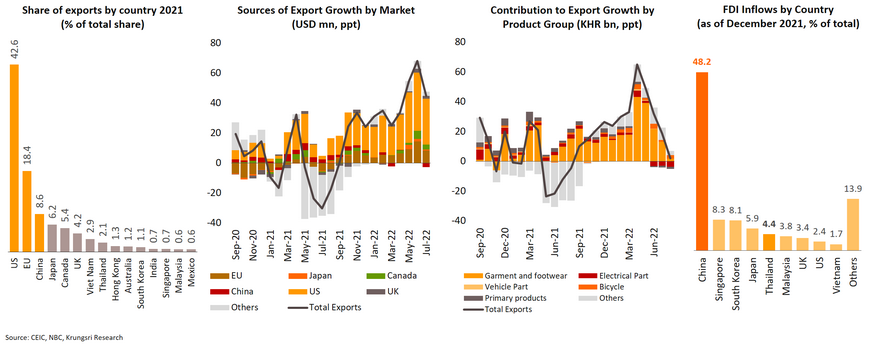

High dependence on exports to the US and Europe and FDI from China exposes the country to weakening demand and shocks

Cambodia depends not only on external demand, with trade in goods accounting for 171 % of GDP in 2021, but also on only a few export markets. The US, the EU, and China combined accounted for about 70% of the country’s total exports in 2021. Given the deteriorating outlook for the US, Europe, and China in 2023, demand for Cambodia’s exports, dominated by garment and footwear, will drop substantially. This is already reflected in the latest export data by market and product. In addition, with China accounting for almost half of FDI inflows, that could drop significantly in 2023 if China does not reopen its borders and relax its zero-COVID policy soon. There will be a shortfall to meet the external financing gap driven by a sizeable current account deficit.

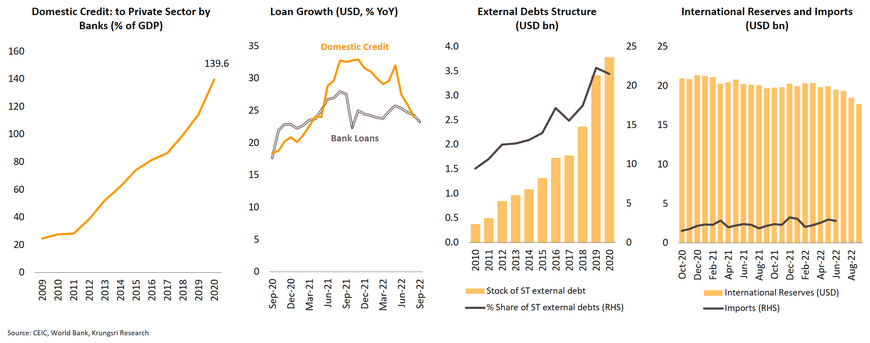

Rising external debts and borrowing amid persistent high loan growth and private debt compounded by rising funding costs have raised concerns about repayment ability

Cambodia has experienced strong credit growth in the past few years, and the ratio of domestic credit to private sector by banks (as % of GDP) had reached 140% in 2020. According to the IMF, outstanding private sector credit was about 170% of GDP in 2021. In addition, credit growth has remained elevated above nominal GDP growth for years. Against the backdrop of tightening global financial conditions and dimmer global growth, there are concerns about repayment and currency mismatch. The country’s short-term external debts are also rising. Any external disruption and shock could lead to a sizeable drop in the country’s international reserves.

Issues to watch in 2023: Focus on external sector resilience

-

Widening of current account deficit and external sector stability

-

Surging cross-border borrowing to support domestic lending amid rising global interest rates

-

China factor and decelerating activity in the real estate sector

-

Implications of the general election in July 2023 and transition of power

Laos: The post-pandemic recovery is ongoing, but prospects remain gloomy with several headwinds emerging and persistent vulnerabilities

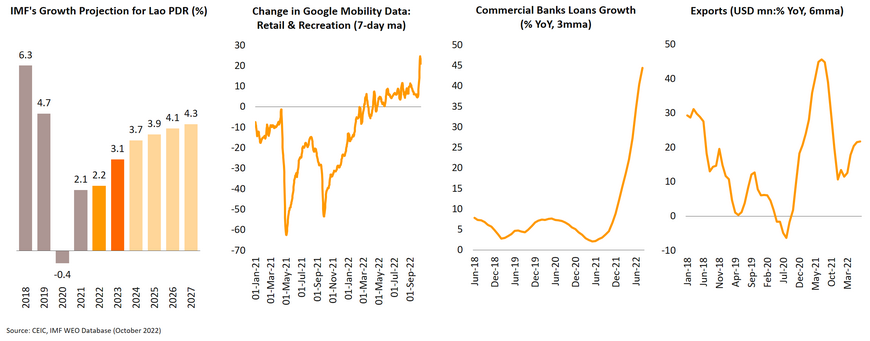

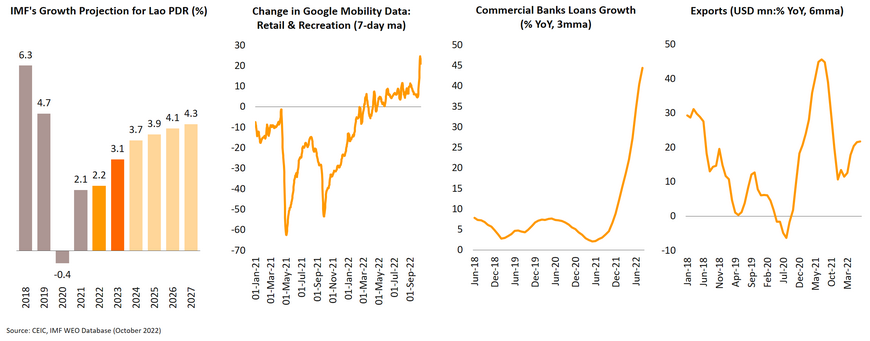

In 2023, the economy is expected to grow by 3.1% following 2.2% expansion in 2022. Growth drivers would be (i) normalizing activities in the services sector; (ii) loan growth; (iii) gradual recovery of the tourism sector; and (iv) export of hydropower, agricultural products, and minerals. However, prospects are tilted to the downside due to both internal and external headwinds. Major risks on the horizon are (1) surging inflation, (2) lingering weakness of the Lao kip, (3) slower-than-expected growth in China and uncertain reopening policy, (4) high external debt burden amid low foreign exchange reserves, and (5) an increasingly unfavorable external environment which could worsen external stability. Against this backdrop, the operating environment in Lao PDR for international firms remains extremely challenging.

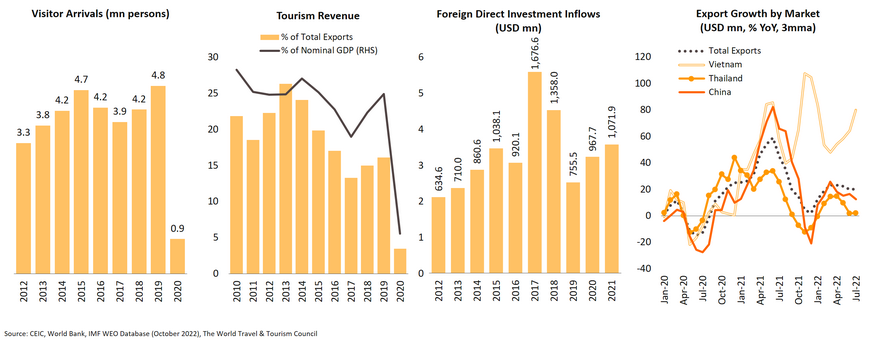

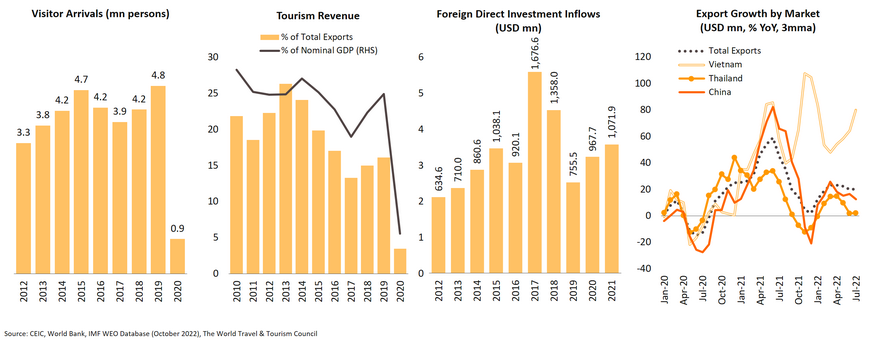

Improving tourism, exports and FDI inflows will boost growth amid dimmer prospects of a recovery of domestic demand due to rising inflation and a weaker kip

Tourism will be a key growth driver for Lao PDR in 2023, supported by reopening of borders and the China-Laos Railway, as recovery in domestic demand could be derailed by the weak kip and rising inflation which reached a new high of 37% YoY in October. The reopening of borders since May 2022 should lead to a gradual recovery in inbound tourism. Visitor arrivals reached 4.8 million in 2019 and the tourism sector contributed 10% of GDP and generated 19% of total employment, according to the World Travel & Tourism Council. The domestic economy could be boosted by FDI inflows, especially in projects related to hydropower and renewable energy, in addition to those spurred by the China-Laos Railway Link. Exports to Thailand and Vietnam should remain strong in line with healthy domestic demand in those two markets, and trade with China could improve following the gradual relaxation of COVID restrictions and Zero-COVID Policy.

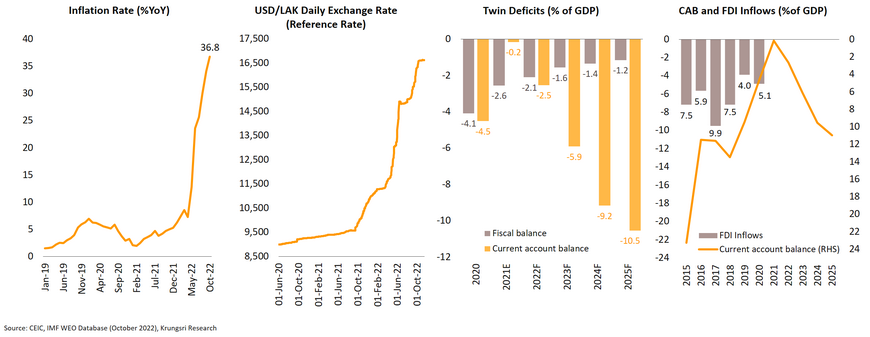

Persistent macroeconomic instability and weak kip will add upward pressure on inflation and undermine confidence of consumers and investors.

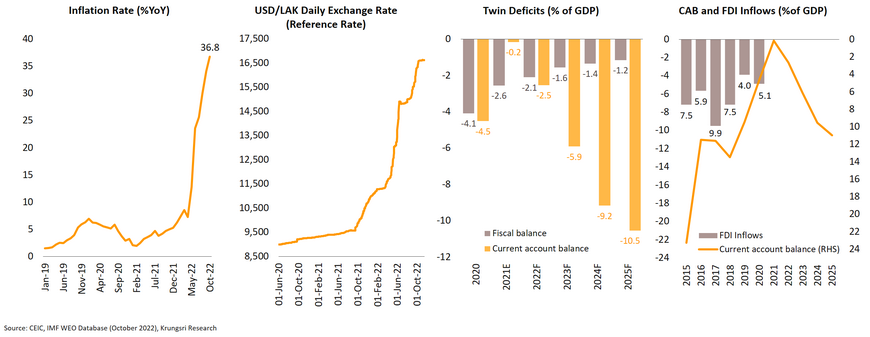

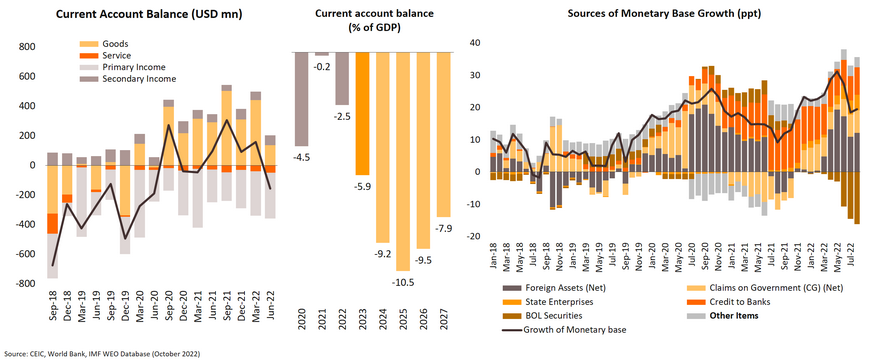

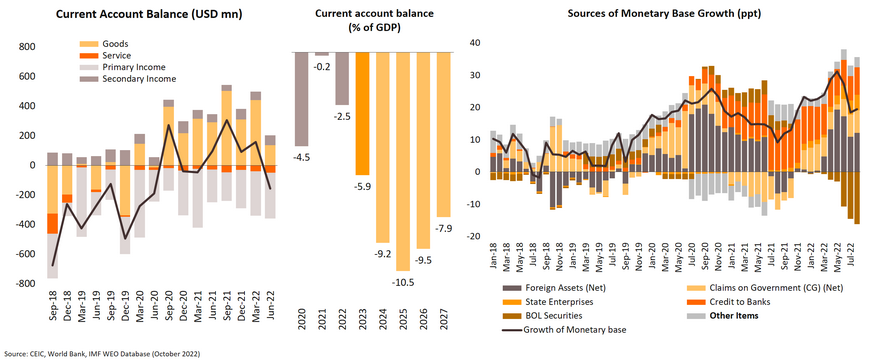

We maintain our medium-term view that weak economic fundamentals and existing vulnerabilities compounded by external headwinds will continue to worsen macroeconomic stability and increase risk of an economic crisis in Lao PDR. On price stability, the authorities and central bank have limited policy instruments to anchor inflation expectations and to contain the depreciation of the kip. On external stability, the persistent depreciation of the LAK against USD is a sign of extreme shortage of USD liquidity in Lao PDR amid lingering twin deficits. Large current account imbalances are not being sufficiently financed by FDI inflows. With high external debt burden and low foreign exchange reserves, this has raised risk of a balance of payments crisis if debt negotiations with major lenders are not successful. This could, in turn, fuel a weaker local currency. Against this backdrop, the macroeconomic environment for consumers and businesses will remain challenging.

LAK will continue to depreciate against USD amid the deteriorating global economic environment

Fundamentally, the USD/LAK exchange rate will continue to depreciate due to the large current account imbalances, thin foreign exchange reserves, and higher external debt obligations to service amid the challenging external environment. The balance of trade in goods has been positive and has contributed to a surplus of the current account. However, going forward, exports are unlikely to be able to offset imports and this will lead to a negative current account balance, due to elevated import prices of fuel and food as the Lao kip continues to weaken. As a result, this suggests the current account deficit will worsen in 2023 and foreign exchange reserves will remain low.

Lao will continue to face liquidity and solvency risks due to high public debt level amid low foreign currency reserves, limited financing options, and tightening global financial conditions

The government’s gross debt is projected to reached 107.1% of GDP in 2022, based on IMF data. Public debt stocks had risen steadily to reach 72% of GDP in 2020. Against the backdrop of low foreign exchange reserves and rapid depreciation of the local currency, Lao PDR continues to face higher liquidity and solvency risks. And according to the World Bank, Lao PDR’s debt service obligations would average USD 1.3bn annually from 2023 to 2026, or equivalent to the country’s average stock of official foreign reserves. Hence, based on these developments, Lao PDR’s debt sustainability crucially hinges on successful negotiations with major bilateral creditors.

Issues to watch in 2023: Lingering external debt distress and risk of an economic crisis

-

Surging inflation fueled by persistent currency depreciation amid high commodity prices

- Large external debt to repay and elevated external liquidity pressure against the backdrop of low foreign-exchange reserves and tightening global financial conditions

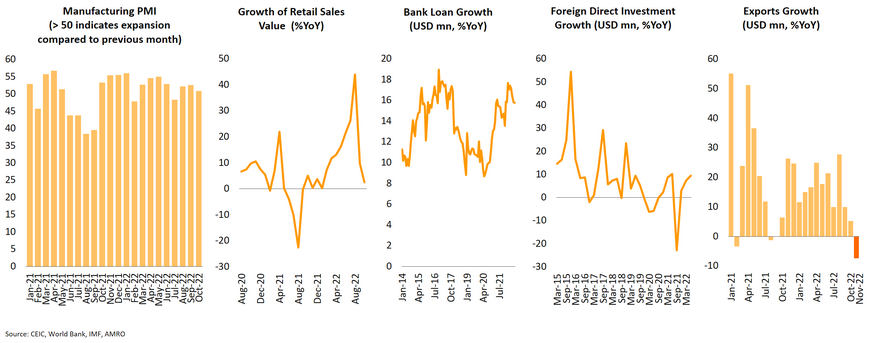

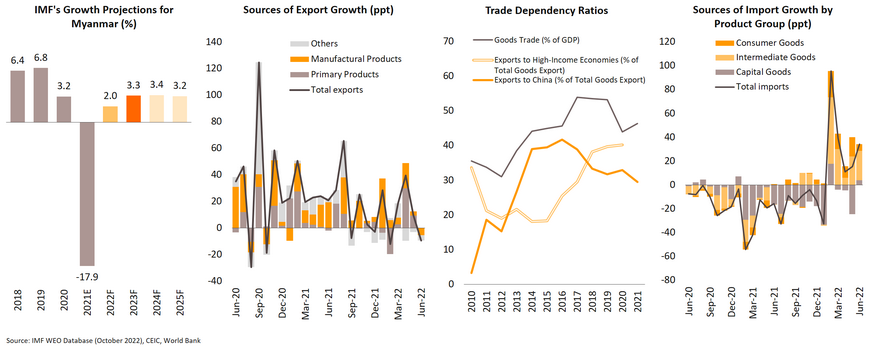

Myanmar: Uncertainties to cap economic prospects despite signs of stabilization; external headwinds continue to pressure macroeconomic stability

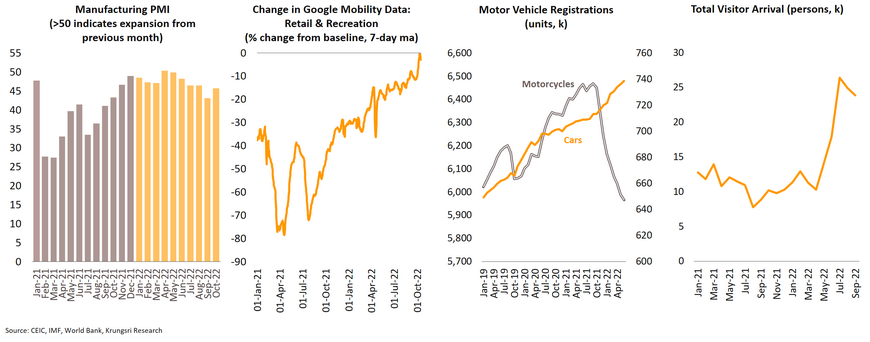

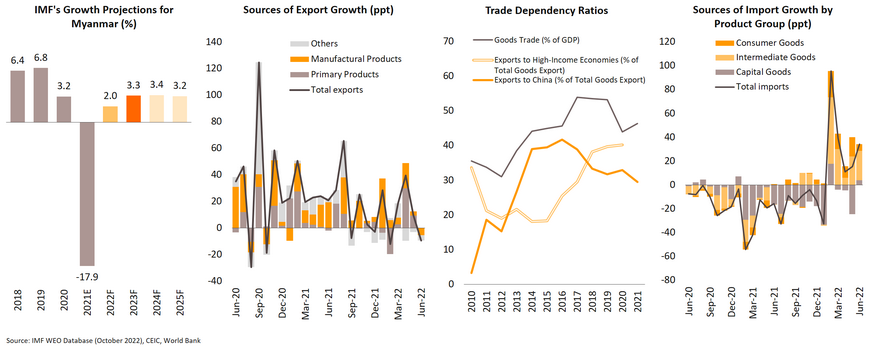

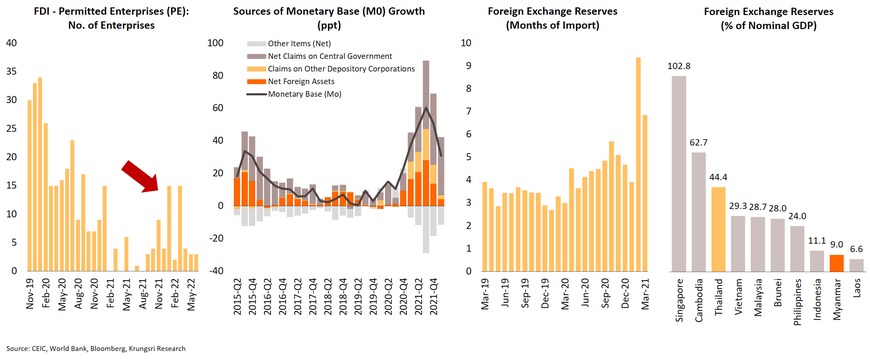

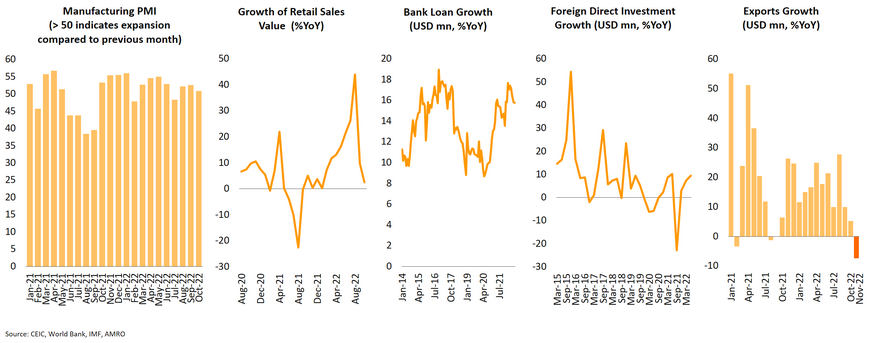

Economic growth is projected to reach 3.3% in 2023 following 2.0% expansion in 2022. Recovering activity in the services sector and the manufacturing sector (albeit at a slower pace) have supported overall activity. However, most indicators reflect weak consumption and investment activity amid rising inflation, more restrictive measures, and external headwinds. Following our recent trip to Yangon in November, despite signs of stabilization, it is confirmed that the economic activity will remain weak in 2023 because the economy continues to face several constraints heightened by stronger external headwinds. Against the backdrop of persistent USD liquidity shortage, we continue to expect higher prices for imported raw materials and consumer goods, domestic unrest and conflict, electricity outages, and persistent logistics and financial sector disruptions. And there is uncertainty over the upcoming general election in 2H 2023. Thus, the overall business and investment climate in Myanmar remains challenging for foreign firms.

Path to recovery remains fragile; upcoming general election in 2H 2023 will shape economic prospects and the medium-term outlook.

The medium-term economic outlook has deteriorated since the political unrest in February 2021. As a result, Myanmar’s potential growth has slipped from 6% to about 3% p.a. In addition to internal headwinds, external challenges are strong, particularly slowing global economic activity and rising global interest rate that could further worsen external stability despite Myanmar’s low dependence on international trade. Recent policy shifts and more restrictive regulations are making things more challenging for both local consumers and businesses. These include trade license requirements and stricter foreign exchange controls, which have resulted in a decline in imports of consumer goods, raw materials, and capital goods. Lingering policy uncertainties will make business operations more complex in the country in 2023 with the exit of large MNCs.

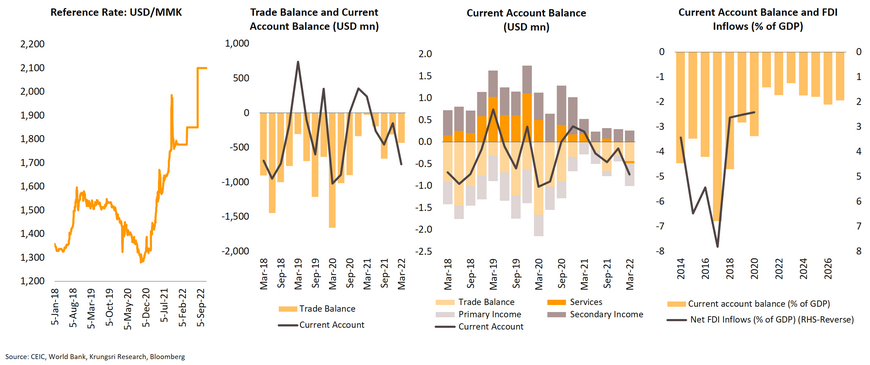

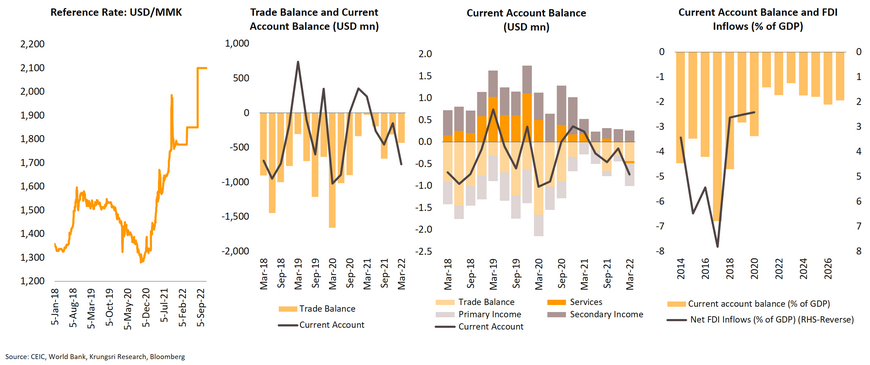

MMK will continue to depreciate against USD due to shortages of USD liquidity

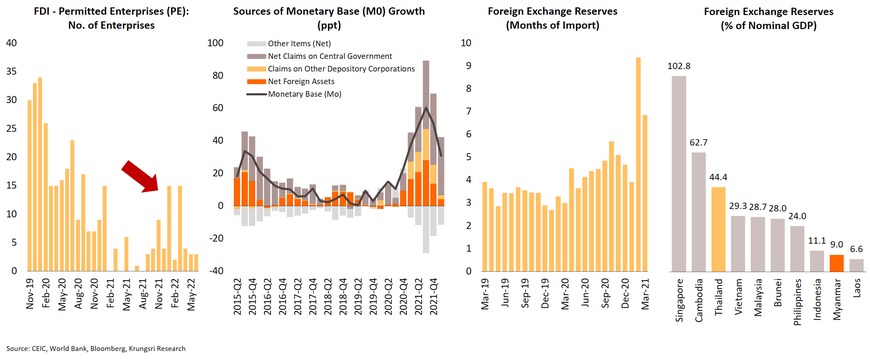

The exchange rate will continue to face downward pressure and the gap between the official exchange rate and parallel rate will widen as the current account imbalance grows and there is insufficient FDI inflows to finance the gap. Tightening global financial conditions and slower global growth will worsen the shortage of US dollar liquidity in Myanmar against a backdrop of being added to the blacklist of the Financial Action Task Force (FATF), declining new FDI inflows, and persistent current account deficit. The authorities and the Central Bank of Myanmar (CBM) have introduced several foreign exchange restrictions, reversing previous reforms to liberalize trade and unify the exchange rate.

External economic stability will remain fragile amid the gloomy global outlook

Downside risks remain elevated and external stability is under pressure given the deteriorating global outlook. New FDI inflows have been declining and MNCs have been exiting the country due to a worsening business climate and weak domestic demand. Against this backdrop, despite sufficient foreign exchange reserves (months of imports), reserves would slip further going forward. The deteriorating external position is a significant risk; it could prompt the authorities to impose more harsher regulations and restrictions.

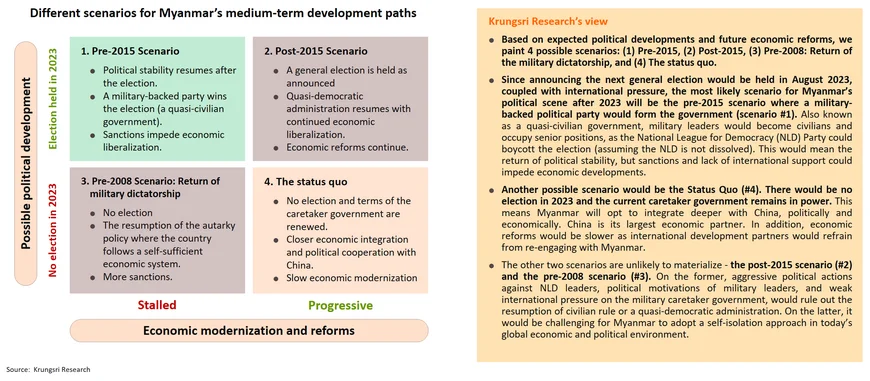

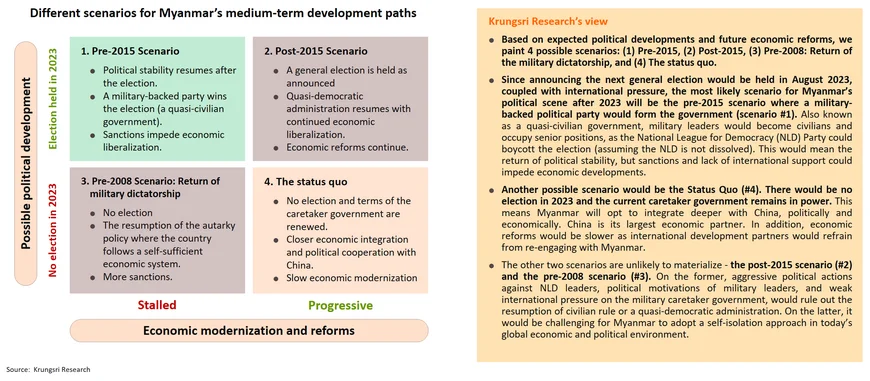

Political transition will be relatively smooth following general election in 2H 2023 as military leaders are expected to remain in power

The current regime has announced the general election will be held in August 2023. The Union Solidarity and Development Party (USDP), a military-linked party, is likely to win the election as the military leaders aspire to remain in power, and the National League for Democracy (NLD) Party might boycott the election like in 2012.

Issues to watch in 2023: Macroeconomic instability and transition of power

-

General election in the second half of 2023 and transition of power

-

Escalating domestic unrest and more targeted sanctions

-

Depreciation of local currency and external sector stability

-

Higher inflationary pressure

Vietnam: Outlook remains positive given resilient domestic demand and FDI inflows despite stronger external headwinds

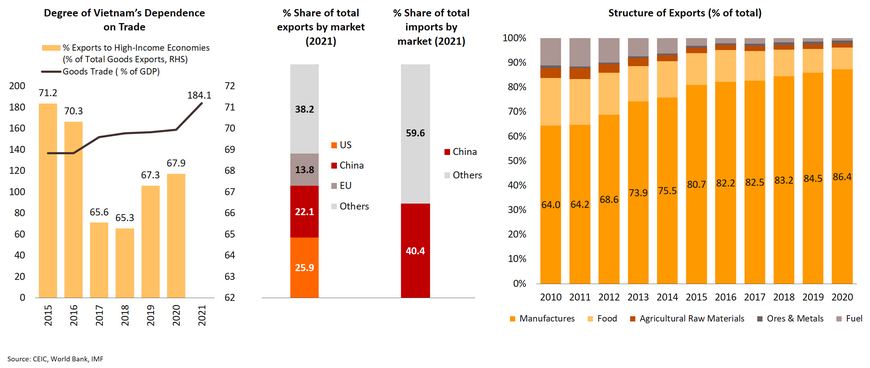

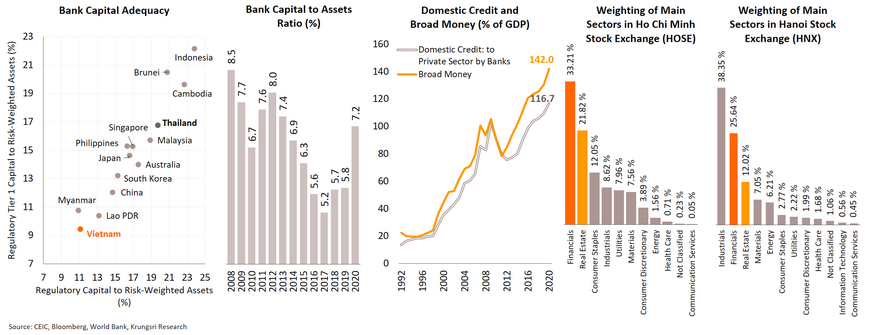

The Vietnamese economy is expected to expand by only 6.2% in 2023 following strong 7.0 % growth in 2022, supported by a surge in domestic and external demand. Vietnam has been dependent on international trade, with trade in goods reaching 184.1% of GDP (vs. Singapore 217.5% in 2021) and given a dimmer global outlook, external demand will weaken. However, the growth drivers will shift towards domestic consumption and investment boosted by healthy FDI inflows amid strong growth in bank loans and manageable inflationary pressure. Despite the relatively positive outlook, there is downside risk to growth. In addition to elevated inflationary pressure and tighter domestic financial conditions, key risks are the vulnerable financial and real estate sectors, and capital adequacy in the banking system is insufficient to absorb shocks amid the unfavorable external environment and higher uncertainties.

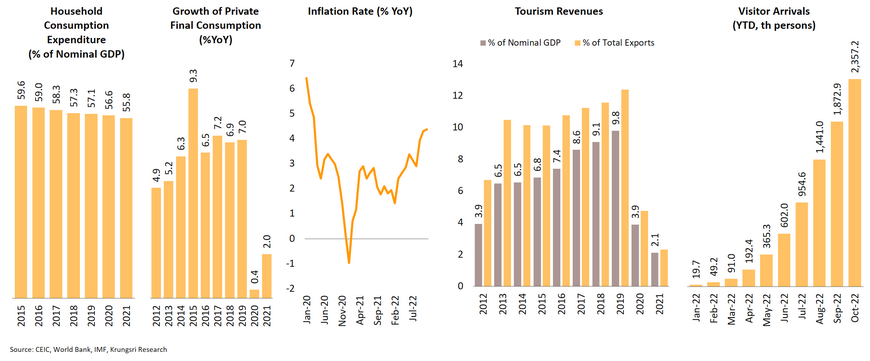

Recovery in domestic consumption and tourism will cushion the impact of weaker external demand

With a sizeable share of household consumption (as % of GDP) and healthy expansion, the recovery in private consumption and inbound tourism coupled with continued FDI inflows will drive growth in 2023 amid internal challenges, including liquidity crunch in the real estate sector, inflation, and higher interest rates. The State Bank of Vietnam (SBV) has raised policy rate by 200bp since Q3 2022 to maintain macroeconomic stability, but this would weigh on domestic economic activity and growth. The resumption of international tourism will boost growth and visitor arrivals has increased substantially. In the pre-pandemic era, tourism revenue accounted for 10% of GDP in Vietnam.

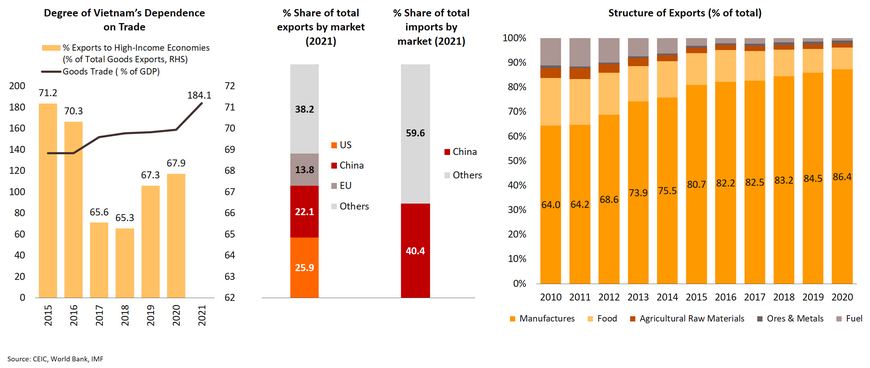

High dependence on external demand exposes Vietnam to the global economic slowdown and shocks

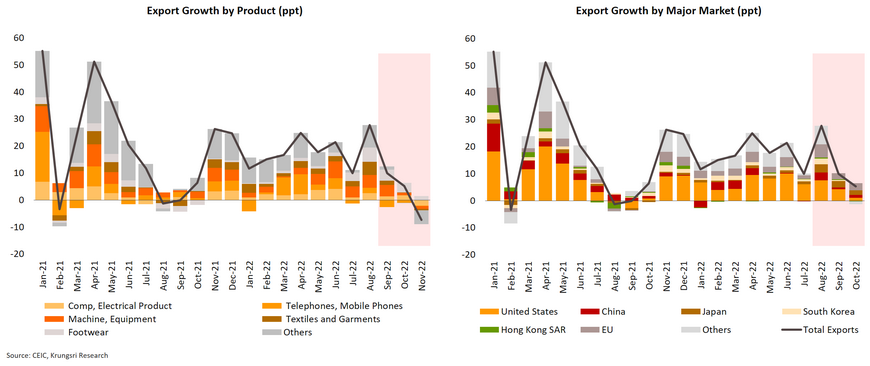

Vietnam is structurally exposed to external shocks as it is highly integrated in the global economy, reflected by high dependence on international trade in goods (184% of GDP in 2021). In addition, there is concentration risk in terms of both export and import markets. the US, the EU and China together account for 62% of total exports. Imports from China account for 40% of total imports. In addition, the country’s exports are dominated by manufacturing products, which could be hurt by the shift in consumption towards services.

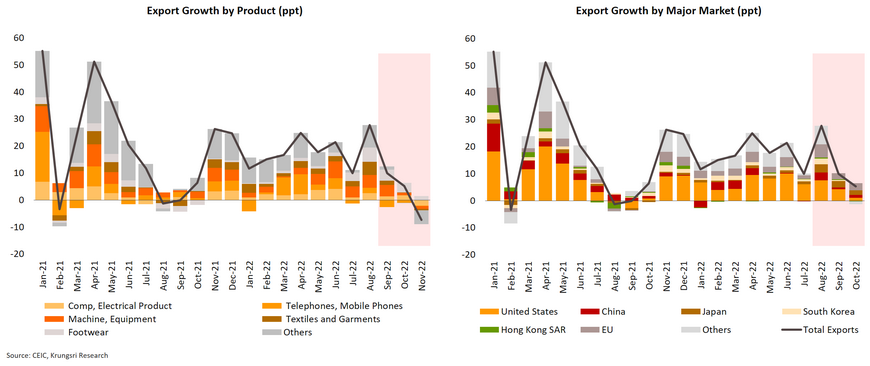

Weakening global demand would hurt Vietnam’s exports substantially in 2023

Exports have supported Vietnam’s growth in 2022. However, weakening global demand led by a slowdown across the US, Europe, and China will weigh on Vietnam's exports in 2023. Total exports has tumbled 7.4% YoY in November, sharply worse than market expectations. Exports of key products including textiles and garments, telephones, and electronics have fallen as consumers in the US and Europe, Vietnam’s largest markets, are spending more on services in the post-pandemic era. This could be worsened by uncertainties over China’s COVID-19 policies.

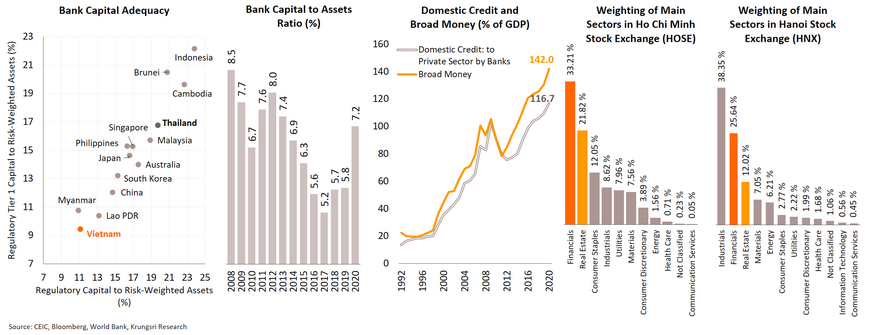

Lingering vulnerabilities in the banking sector could weigh on macroeconomic stability and growth

Persistent inadequate capital in the banking sector has emerged as vulnerability since Vietnam has used bank lending to boost economic growth over the past decades. Currently, Vietnam has the highest level of outstanding domestic credit to private sector by banks at 142% of GDP. In the post-pandemic recovery period, banks’ loan growth has rebounded rapidly amid thin capitalization and weaker bank balance sheets because of the pandemic. This exposes banks to inferior credit quality and weakens their ability to absorb shocks. There is also growing concentration of lending to the construction and real estate sectors, further exposing banks to risks of correction in property prices. The latest bank run in October reflects Vietnam’s fragile banking system. Weak confidence has ripple effects on the country’s stock markets as the banking and real dominate the markets in Ho Chi Minh City and Hanoi. If the banks’ capital positions are not addressed properly soon, it could be a key risk to macroeconomic stability for Vietnam.

Issues to watch in 2023: Monitor internal and external headwinds

-

Heightening inflationary pressure and impact of rising interest rates on domestic demand

-

Worsening external demand and external sector stability amid tightening global financial conditions

-

Developments in the real estate sector and banking sector stability

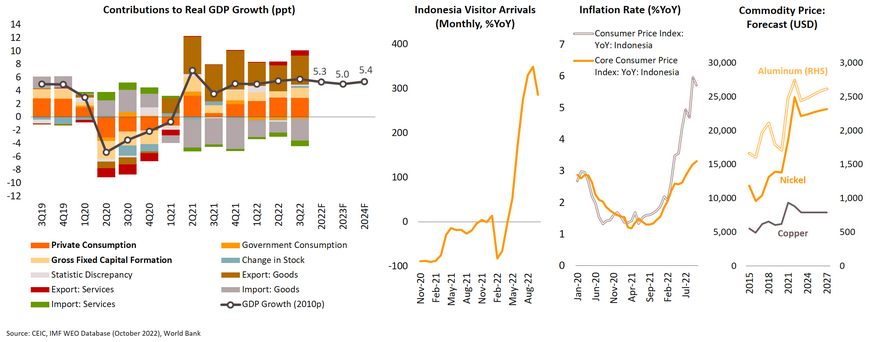

Indonesia: Slower growth, but there is support from resilient domestic demand amid a weaker global economy

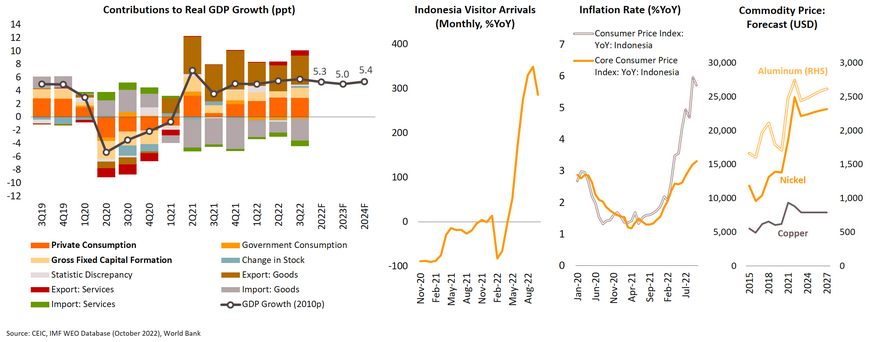

Growth will slow to 5.0% in 2023 from 5.3% in 2022, according to the IMF. Despite a dimmer global outlook, the post-pandemic recovery and normalizing economic activity, particularly domestic demand and tourism, will support Indonesia’s economic growth in 2023. Indonesia is less vulnerable to a global slowdown because of its sizeable domestic demand. However, risks are tilted to the downside. Inflationary pressure is building up and could persist as domestic consumption recovers, because of smaller fuel subsidies. Compounded by tightening domestic financial conditions as the central bank continues to hike policy rate to curb inflation, this could weaken household consumption, its key growth engine. On the external front, weaker global demand leading to lower commodity prices could also dampen Indonesia’s export revenues and current account position.

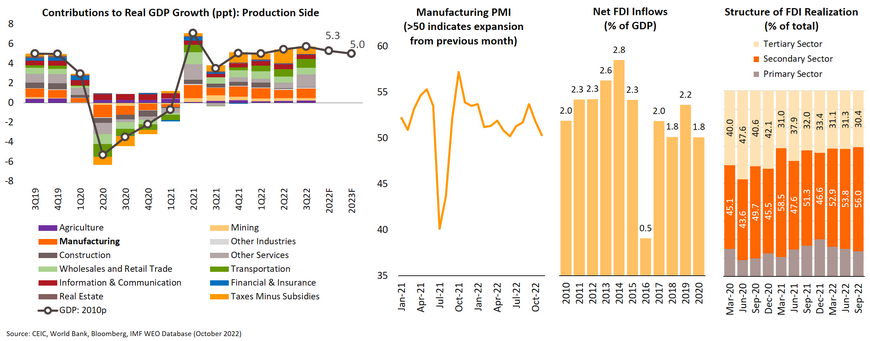

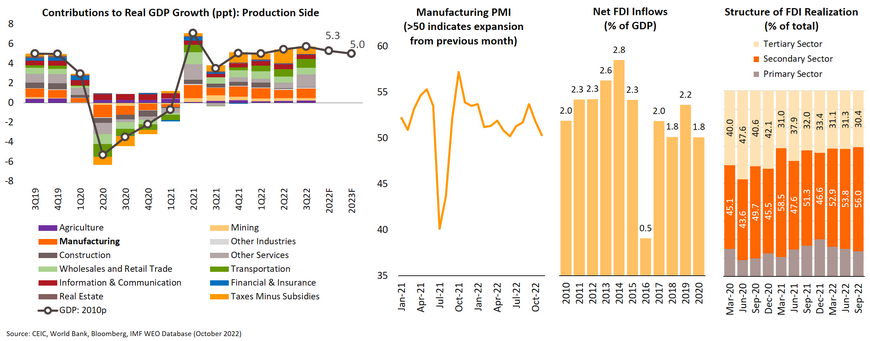

Manufacturing sector is expected to benefit from investments and FDI inflows in the downstream commodity sector

The darkening growth outlook at home and abroad in 2023 will affect economic activities. However, against the backdrop of a post-pandemic recovery in investment and diversification of supply chains by MNCs amid the government’s structural reforms to ease foreign investment restrictions, we expect manufacturing activity to remain strong. Over the past years under President Jokowi’s administration, the government has continued to promote investment in the downstream commodity sector with incentives and restrictions including import bans. Therefore, Indonesia is seeing an investment boom in its downstream commodity sector, especially the nickel supply chain. It is now the world’s largest exporter of stainless steel and could eventually become a major producer of EV batteries. This would support GDP growth, jobs, and external finances.

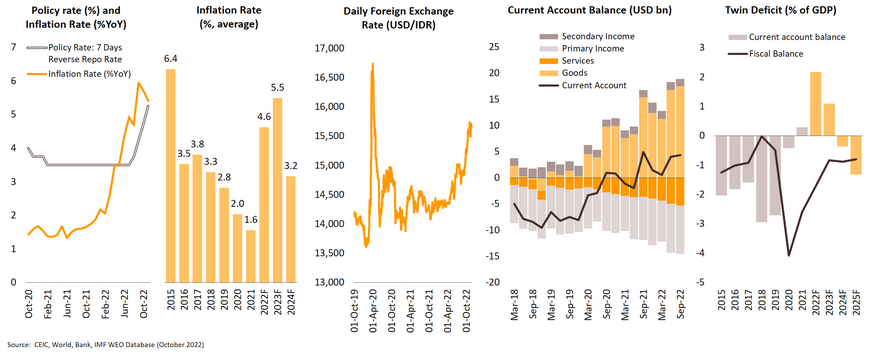

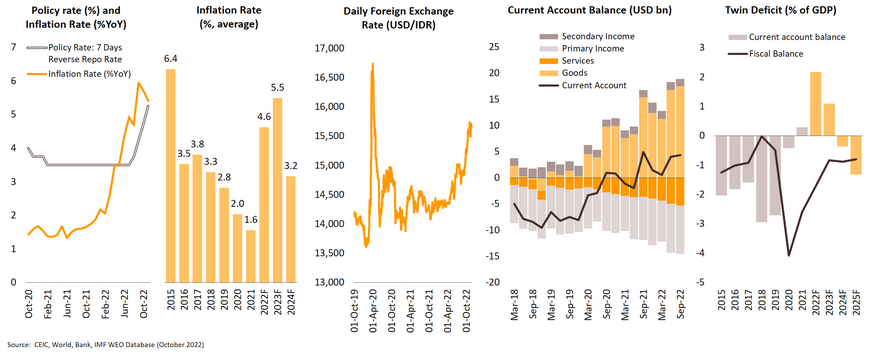

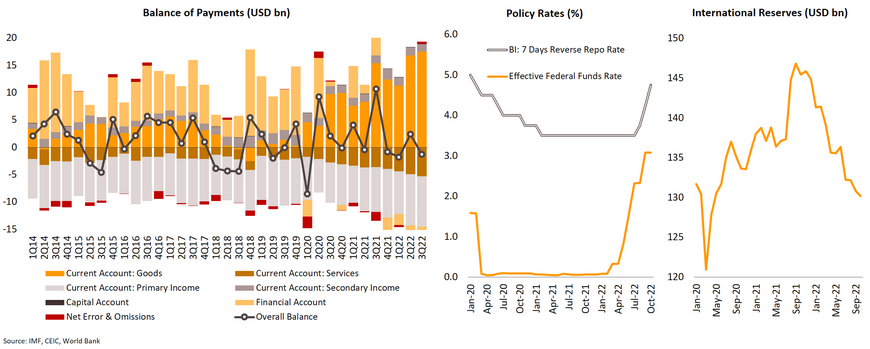

Policies will shift towards maintaining macroeconomic stability; BI will hike rates further to curb inflation and fiscal stance will be less accommodative

In 2023, policy priorities for Indonesia will be targeted at maintaining macroeconomic stability, and this means policies will become less accommodative for growth. On the monetary policy front, Bank Indonesia (BI) will likely continue to raise policy rate to curb inflation and maintain external stability. It is projected to hike rate by 100bp to 6.25% by Q1 2023, which will be the terminal rate in this tightening cycle. On fiscal policy, the government wants to pursue fiscal consolidation by reducing 2023 budget deficit to below 3% of GDP following unconventionally large fiscal support during 2019-2022 to cushion the economic impact of the pandemic. This would help to reduce external financing needs and pressure on the currency.

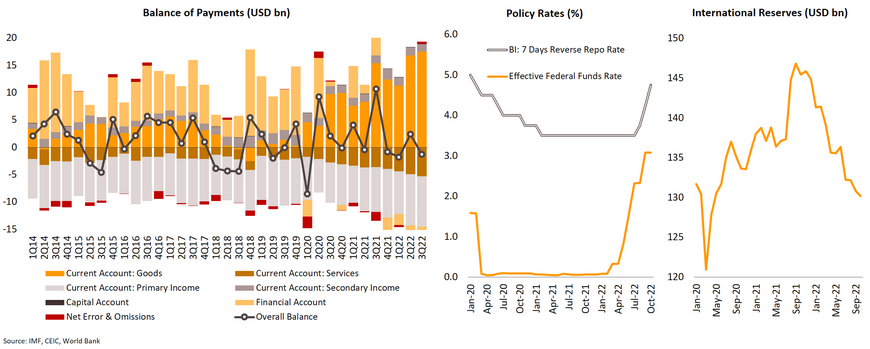

Exchange rate will be under pressure as current account surplus will narrow amid tightening global financial conditions

Indonesia has benefited from elevated commodity prices since the pandemic, as it is among the largest exporters of coal, palm oil, nickel, and copper. This has led to a sustainable sizeable trade surplus and subsequently, a current account surplus. As a result, coupled with BI’s intervention in the foreign exchange market, the central has managed the IDR exchange rate fluctuations relatively well compared to its neighbors. However, with global demand set to slow, commodity prices will correct sooner or later and this will dampen Indonesia’s export revenues and current account position. If those corrections are compounded by rising global interest rates, it could disrupt Indonesia’s external stability and macroeconomic stability. Against this backdrop, the exchange rate will be under downward pressure in 2023.

Issues to watch in 2023: External stability amid a disruptive external environment

-

Global economic slowdown leading to corrections in global commodity prices

-

Narrower current account surplus and external stability

-

Impact of elevated inflation and higher interest rates on domestic demand

Philippines: Growth will decelerate as central banks shifts policy to focus on maintaining macroeconomic stability amid greater internal and external challenges

Growth is expected to slow to 5.0% in 2023 from 6.5% in 2022, (vs. government’s forecast of 6.0-7.0%). Key growth drivers in 2023 would be household consumption and both private and public investment. Final consumption making up almost 80% of the country’s nominal GDP, and other indicators including wholesale & retail trade and consumer loan growth indicate strong consumption. In addition, in 2023, remittances which account for about 10% of GDP should continue to grow and support household consumption. However, the outlook is tilted to the downside as rising inflation, tightening financial conditions, and a depreciation of the PHP could cripple domestic demand. The current administration aims to achieve 6.5-8.0% annual growth over 2023-2028.

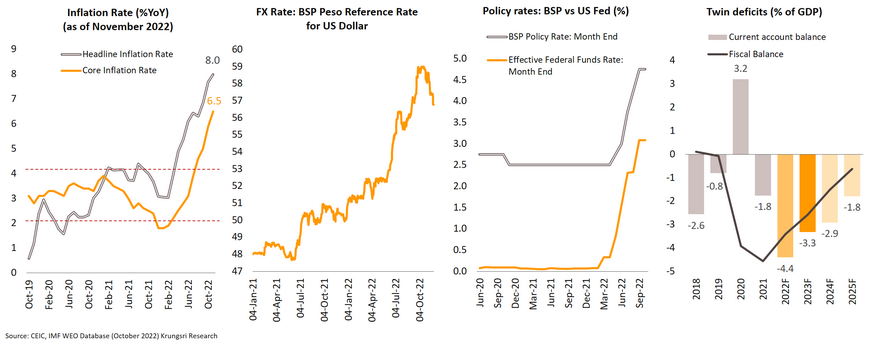

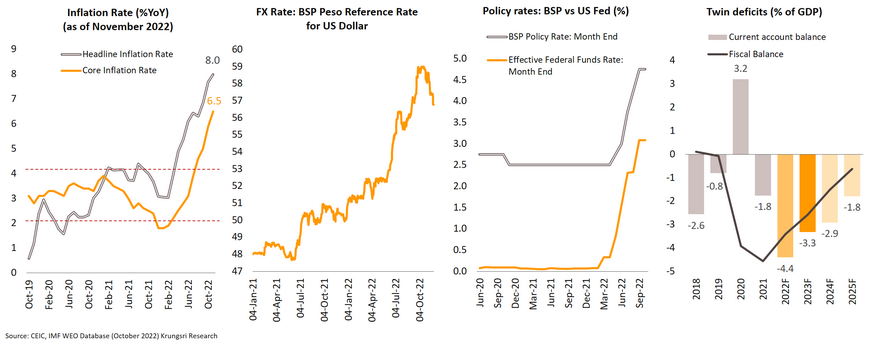

Financial conditions will remain tight to anchor inflation expectations and maintain external stability

Inflationary pressure will persist into 2023 amid tighter global financial conditions. Hence, we expect the Bangko Sentral ng Pilipinas (BSP) to raise policy rate by another 100bp to 6.50% by Q1 2023 (vs. current policy interest rate of 5.5% in December 2022). Inflation rate had reportedly reached a 14-year high of 8.0% YoY in November, which prompted the BSP to deliver another 50bp hike at its last policy meeting in 2022 on 15 December. In 2023, the pace of policy rate hike will be slower as the BSP might have to preserve stability and growth; raising policy rates aggressively will ease pressures on the peso but it could dampen growth. On the fiscal front, the government aims to reduce the public debt-to-GDP ratio to 50% by 2028 from 62% currently. This also should reduce pressure on external financing needs and overall external stability.

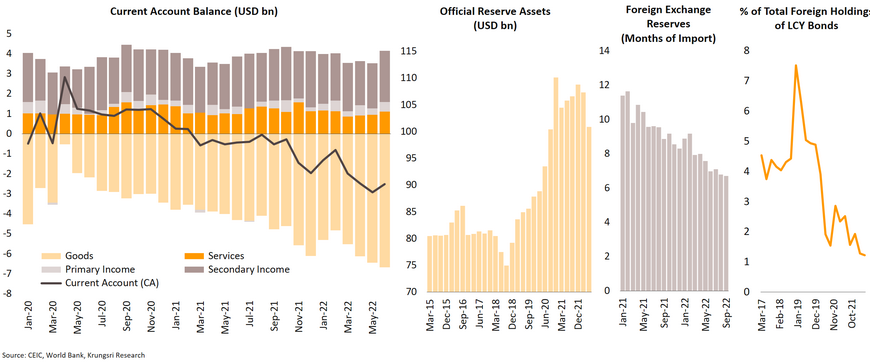

External stability remains sound, but firm domestic demand could worsen the current account imbalance and put pressure on the exchange rate

The current account balance will turn negative in 2023 driven by recovering domestic demand, especially household consumption, and infrastructure investment amid high commodity prices. Despite the deficit, external stability will remain resilient partly because of low level of foreign holding of local currency bonds. A widening current account imbalance compounded by rising global interest rates will add downward pressure on the exchange rate, while the BSP will remain vigilant on preserving external stability and intervening in the forex market to prevent excessive depreciation of the peso.

Issues to watch in 2023: Impact of rising inflation and interest rate on domestic demand

-

Impact of elevated inflation and rising interest rates on domestic demand

-

Uncertainties in global financial markets and the impact on external stability and exchange rate