Global: Trade war ignites, uncertainty looms, turbulent times ahead

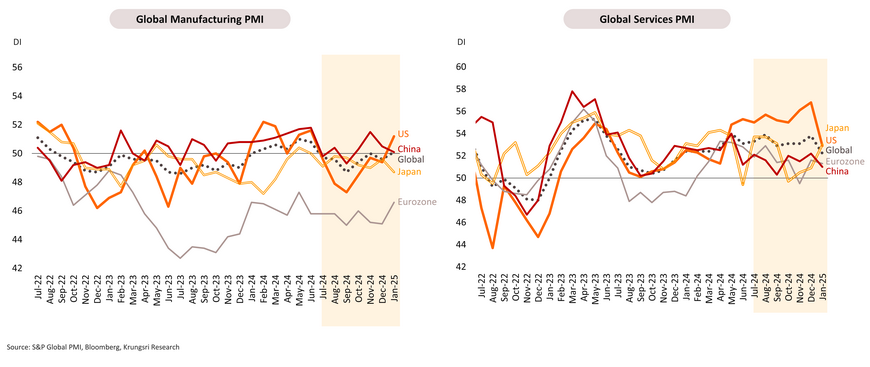

Global growth slows to a year-low in early 2025; manufacturing rebound struggles against service sector slowdown and rising trade tensions

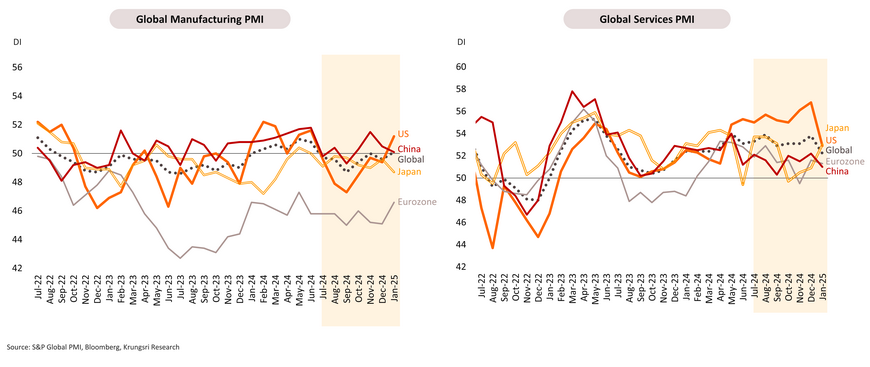

The Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, dropped from 52.6 in December to 51.8 in January. This level indicates global economic growth at an annualized rate of 2.3%, down from 2.7% in 4Q24, and below the pre-pandemic average of 3.1%. Growth in major economies remained driven by the services sector, though global services expansion decelerated. The US business activities continued to outpace those of other developed economies, while China’s growth struggled with weak momentum.

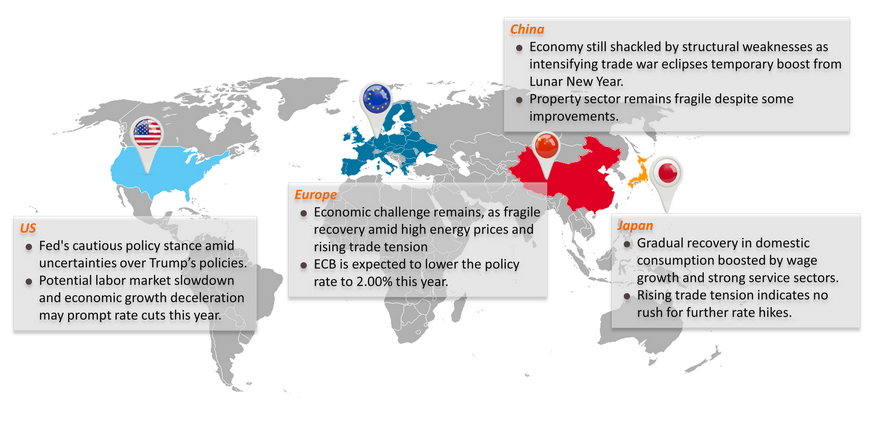

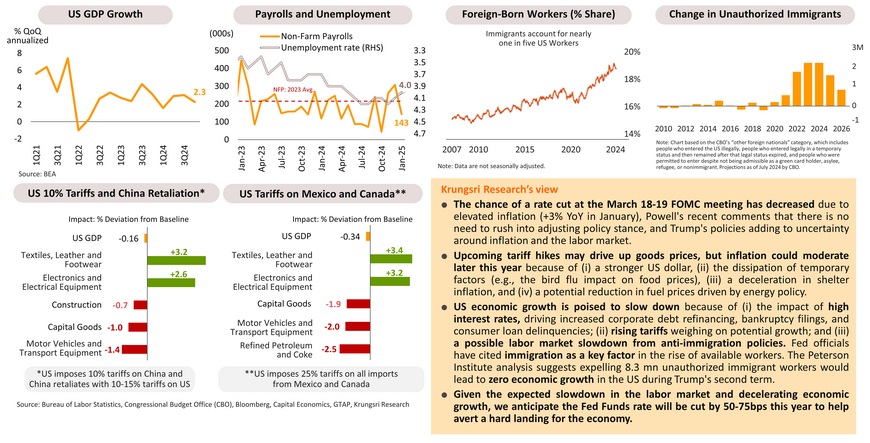

US: Fed’s cautious policy stance amid uncertainties over Trump’s policies; potential labor market slowdown and economic growth deceleration may prompt rate cuts this year

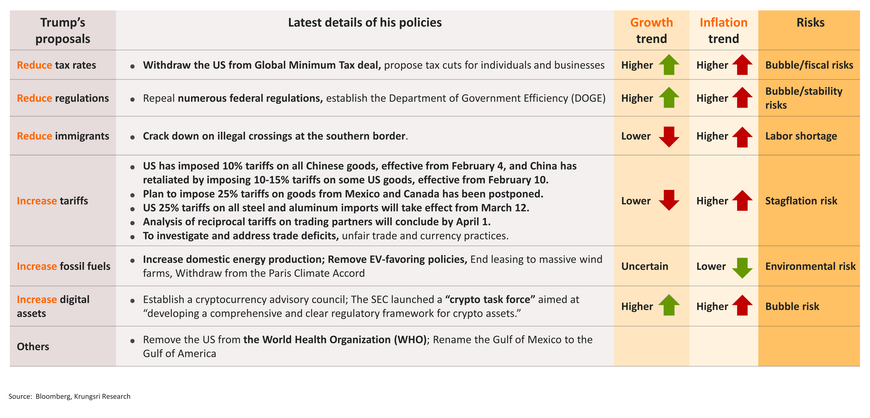

Donald Trump is promising a “golden age of America” in his second term; his policies could create bubble risks, raise inflation, and hurt medium-term economic growth

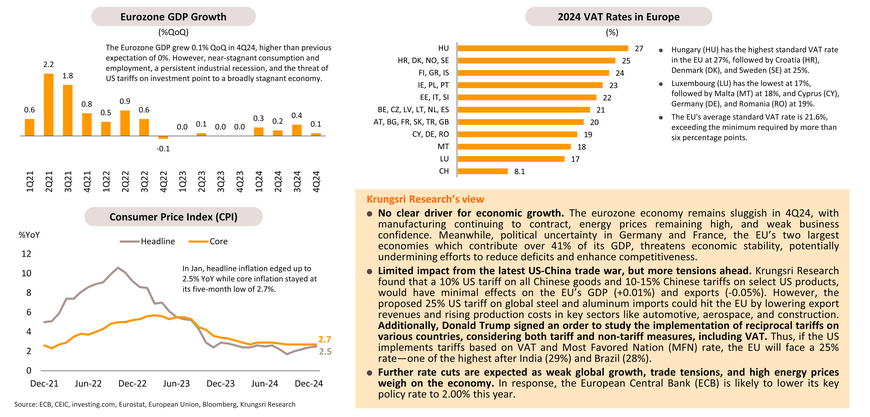

Eurozone: Economic challenge remains as fragile recovery amid high energy price and rising trade tension

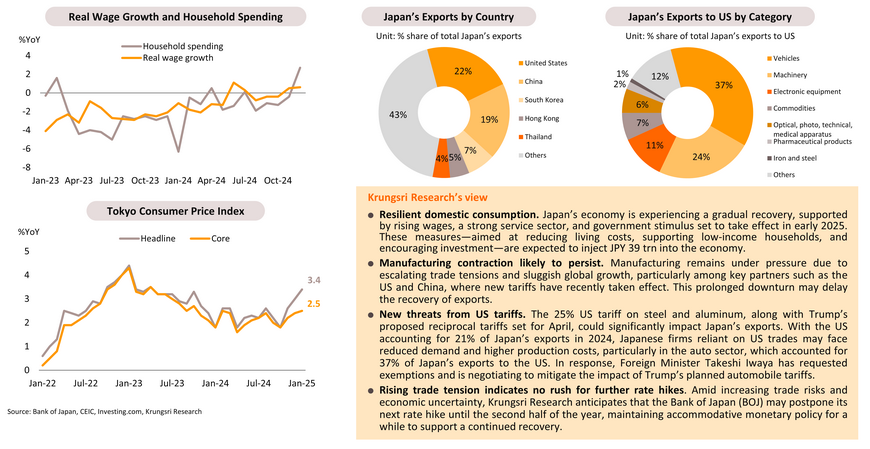

Japan: Gradual recovery in domestic consumption boosted by wage growth and strong service sector, but trade tensions pose risks

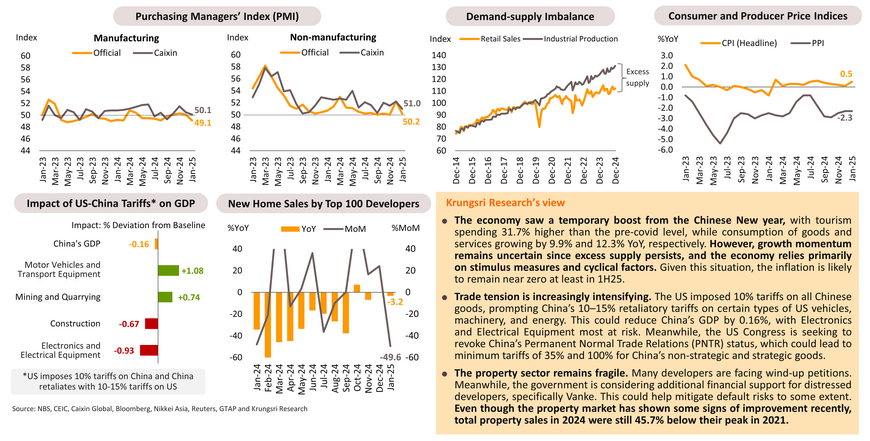

China: Economy still shackled by structural weaknesses as intensifying trade war eclipses temporary boost from Lunar New Year

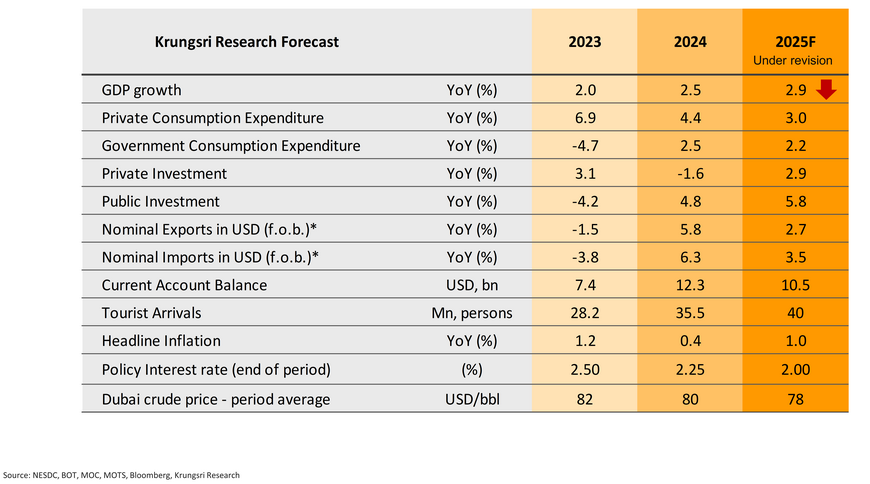

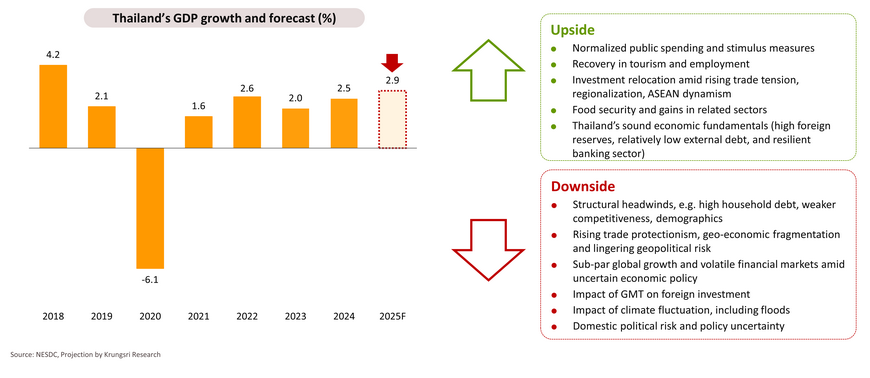

Thailand: 2025 growth forecast under revision; weak domestic economy, slow tourism recovery and limited stimulus gains cloud outlook

-

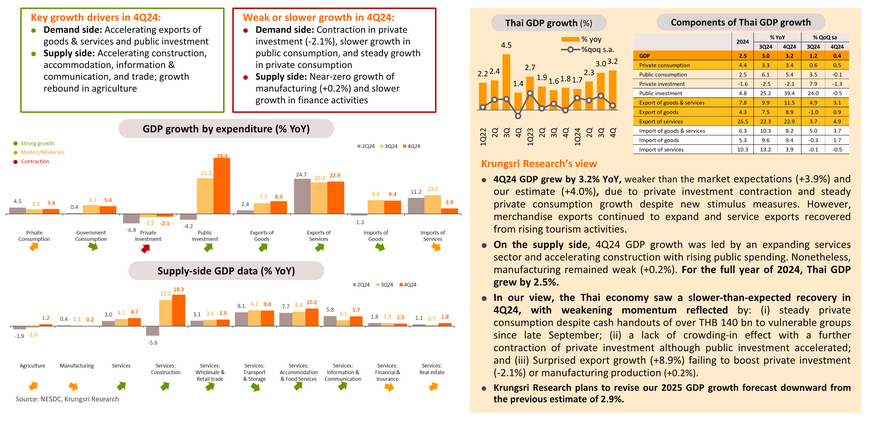

4Q24 GDP growth disappoints at 3.2% YoY and 0.4% QoQ, despite large stimulus measures and growing exports, causing 2024 GDP to grow only at a tender rate of 2.5%. We plan to lower 2025 GDP forecast from 2.9%.

-

Tourism may not reach pre-COVID levels in 2025 due to slower-than-expected recovery of Chinese tourists.

-

Momentum in public spending remains crucial early this year but lacks crowding-in effects.

-

Private investment sees modest rebound. Weak sentiment and struggling manufacturing hold back growth.

-

Private consumption is expected to slow amid weak income, high household debt and limited stimulus impacts.

-

Thai exports grew surprisingly in late 2024 but could not translate into a boost for investment and production. Rising as trade tensions and declining competitiveness will threaten growth.

-

Thailand faces the risk of US tariff hikes due to its large trade surplus with the US. For Trump’s recent tariff plan, the positive impact on Thailand is limited to only some specific industries, but many industries could suffer from tariff hikes. Thailand is among countries at risk from US reciprocal tariffs, and may face the most impact in ASEAN.

-

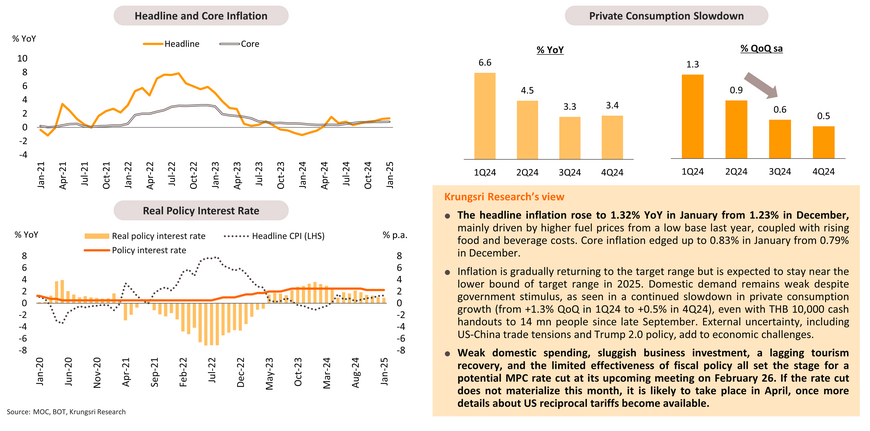

For the policy rate outlook, weak domestic spending, sluggish business investment, a lagging tourism recovery, and the limited effectiveness of fiscal policy all set the stage for a potential MPC rate cut.

Krungsri Research Forecasts for 2025

4Q24 GDP growth disappoints at just 3.2% year-on-year and 0.4% quarter-on-quarter despite large stimulus measures

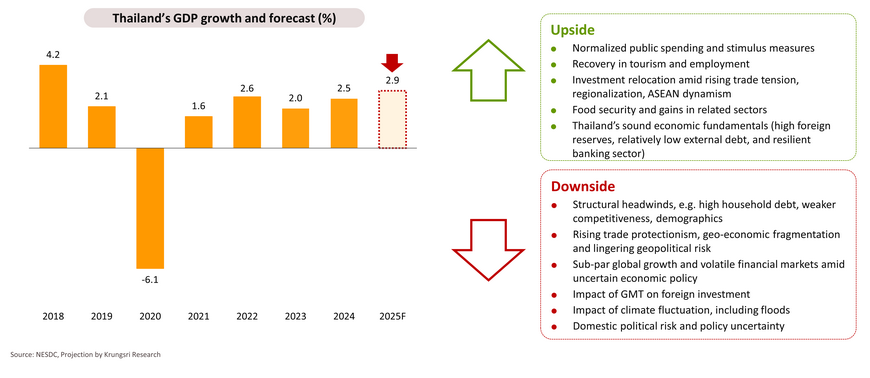

2025 growth forecast under revision due to weak momentum and slow tourism recovery

We plan to revise our 2025 GDP growth forecast downward from the previous estimate of 2.9%, due to: (i) Signs of weakness in private consumption and private investment; (ii) Limited impact of cash-handout measure (Phase 2 program worth just THB 30 bn in 1Q25 vs Phase 1 worth THB140bn in 4Q24). Additionally, a budget of around THB157bn planned to finance the Digital Wallet policy this year is unlikely to contribute significantly to the economy, as seen with impacts of Phase 1; (iii) Potential shortfall in foreign tourist arrivals from the projected 40 mn, due to slow recovery of Chinese tourists; and (iv) Potential fading of front-loaded gains in exports, as concerns about US tariff hikes could turn into actual tariffs.

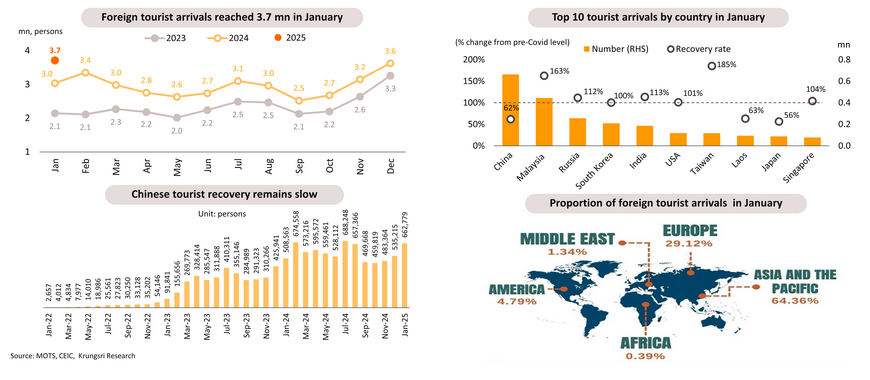

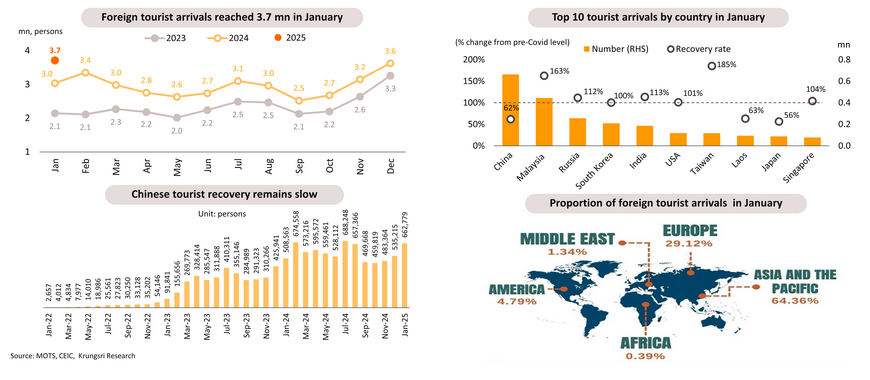

Tourism may not reach pre-COVID levels in 2025 due to slower-than-expected recovery of Chinese tourists

In January 2025, Thailand welcomed 3.7 mn foreign tourist arrivals, a 19.5% YoY increase and rising from 3.6 million in December. This generated THB 182 bn in revenue, up 32% YoY, with the majority being short-haul tourists, led by Chinese tourists, the largest group. However, Chinese tourist arrivals accounted for only 62% of pre-COVID levels. In contrast, tourist arrivals from Malaysia, Russia, South Korea, and India surged to 100-163% of pre-pandemic levels. The full recovery of international tourism to pre-COVID levels remains a challenge this year, as a recovery in Chinese tourist arrivals remains slow, facing short-term pressures from concerns over travel safety in Thailand.

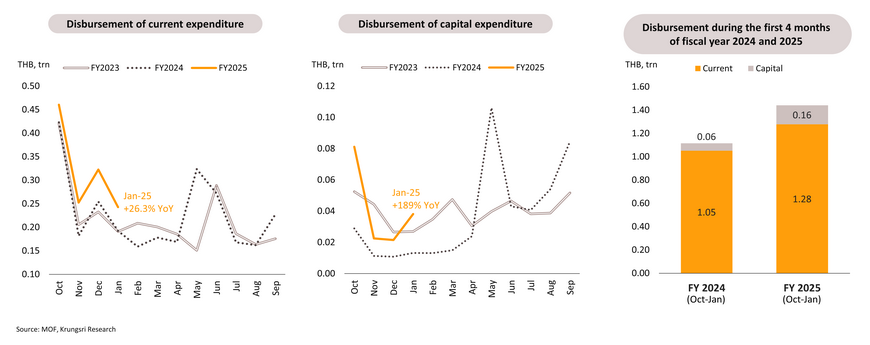

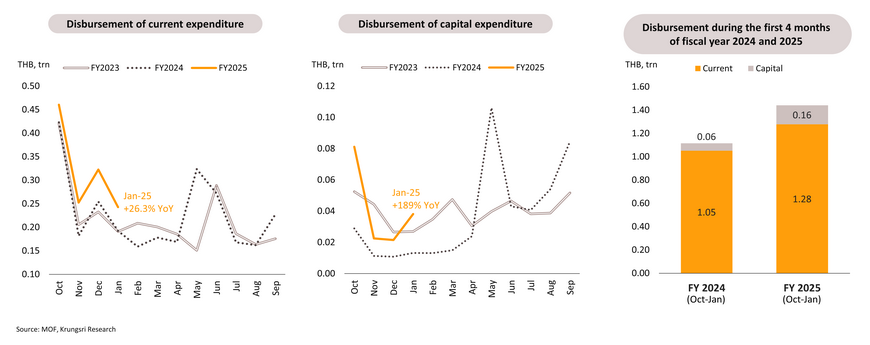

Momentum in public spending remains crucial early this year but lacks crowding-in effects

Public spending in January 2025 continued to grow at an accelerated rate, as reflected by the disbursement of the current budget and capital budget, which expanded by 26.3% YoY and 189%, respectively. In the first four months of FY2025 (October 2024-January 2025), disbursement of the current budget increased by 21.6% YoY to THB 1.28 trn or 45.9% of the budget. Disbursement of the capital budget surged 154.1% YoY to THB 0.16 trn or 16.8% of the annual capital budget. The continuity of momentum from public spending is a key driving factor for the economy, which is facing challenges from external factors, particularly escalating trade tensions. However, there is a lack of crowding-in effect and a further contraction of private investment (-2.1% YoY in 4Q24), although public investment accelerated.

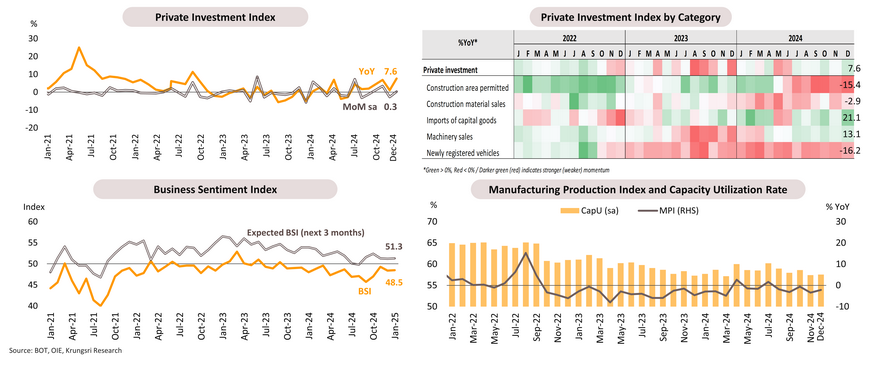

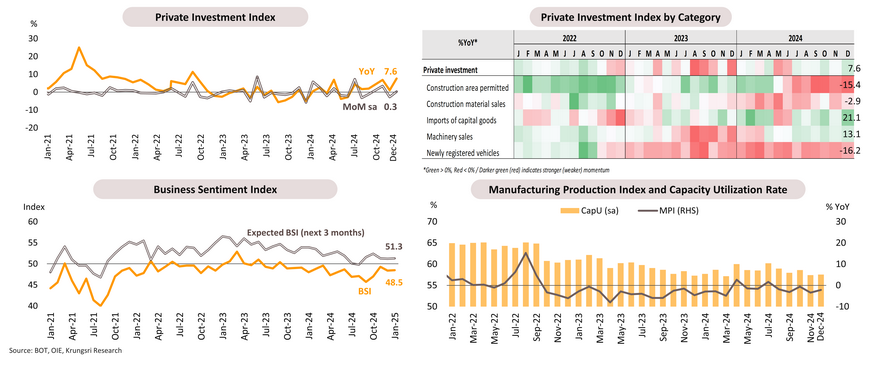

Private investment sees modest rebound; weak sentiment and struggling manufacturing hold back growth

Private investment has gradually recovered and is showing more positive signs, as reflected in: (i) the private investment index in December, which expanded by 7.6% YoY; (ii) the acceleration of capital budget disbursements, which should help stimulate related private investment; and (iii) the BOI's issuance of investment promotion certificates in 2024, with a total investment value of THB 846.5 bn (+72% YoY). However, several headwinds could impact the recovery of private investment, including: (i) the Business Sentiment Index (BSI) remaining below 50 in January for the 16th consecutive month; (ii) structural problems in the manufacturing sector, with the Manufacturing Production Index contracting by 1.7% in 2024; (iii) challenges from the implementation of a global minimum tax starting in early 2025; and (iv) intensified trade tensions amid the Trump 2.0 policy.

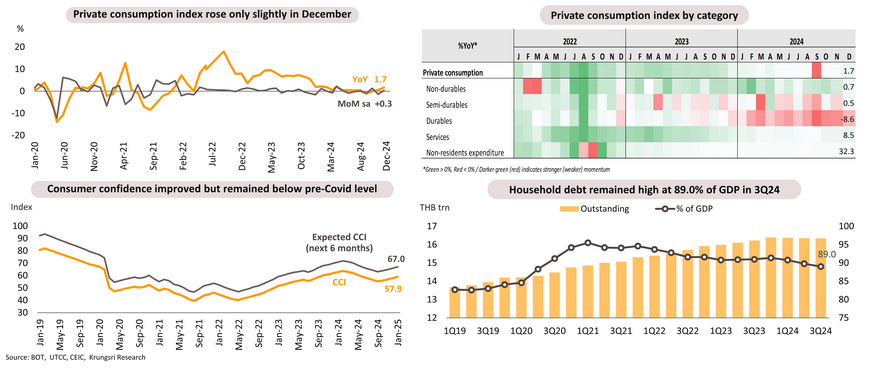

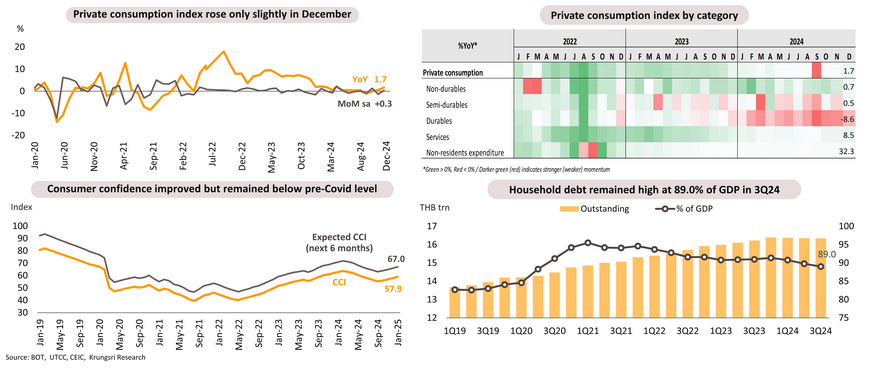

Private consumption is expected to slow amid weak income, high household debt and limited stimulus impacts

Private consumption growth is expected to slow in 2025 though still expanding in line with overall economic growth, driven by (i) the further recovery of tourism and the service sector, which would support employment, and (ii) government stimulus measures such as the Easy E-Receipt program and the THB 10,000 cash handout (Phase 2 worth THB 30 bn). Consumption may be constrained by slow recovery in real wages (+3.2% change from pre-COVID levels), declining agricultural income due to price factors, and persistently high household debt despite government support for small-scale borrowers.

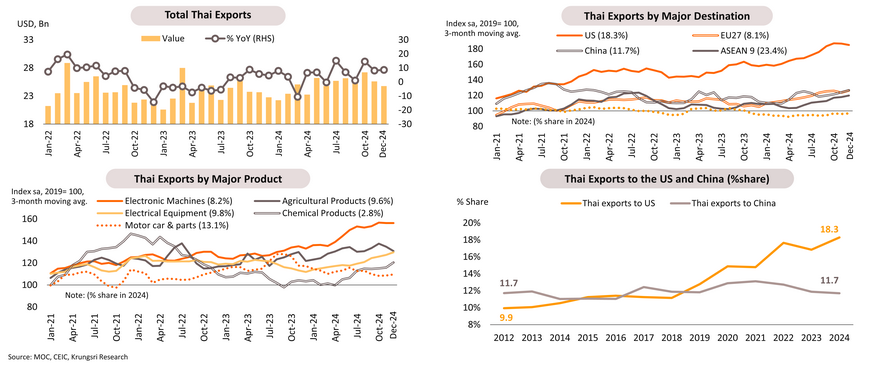

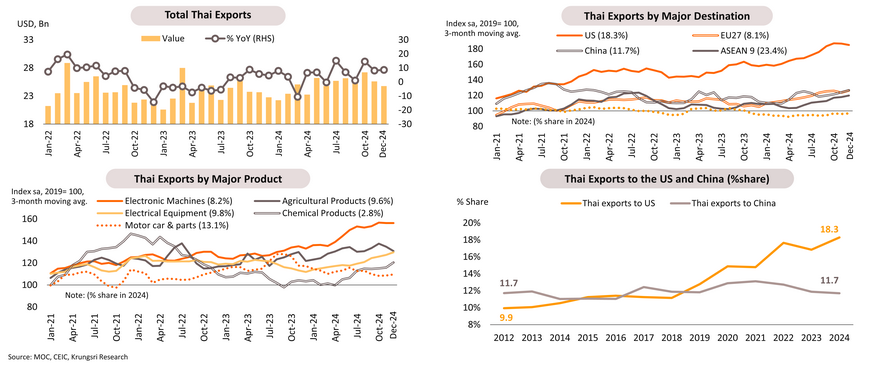

Thai exports grew unexpectedly in late 2024, but trade tensions and declining competitiveness threaten future growth

Exports in December expanded by 8.7% YoY, partly due to the acceleration of imports by trading partners in preparation for the uncertainty surrounding President Trump's future trade policy. Regarding the outlook for Thai exports in 2025, Krungsri Research expects Thai export growth to slow down, facing ongoing pressure from structural issues such as the declining competitiveness of many Thai industries. This is further compounded by the risk of escalating trade tensions and increased competition from Chinese products, which are expected to enter the global market in greater volume if the US imposes harsher tariffs on Chinese goods.

Despite surprising growth, export expansion not broad-based and fragile amid weak global demand, Trump 2.0 policy, and domestic structural headwinds

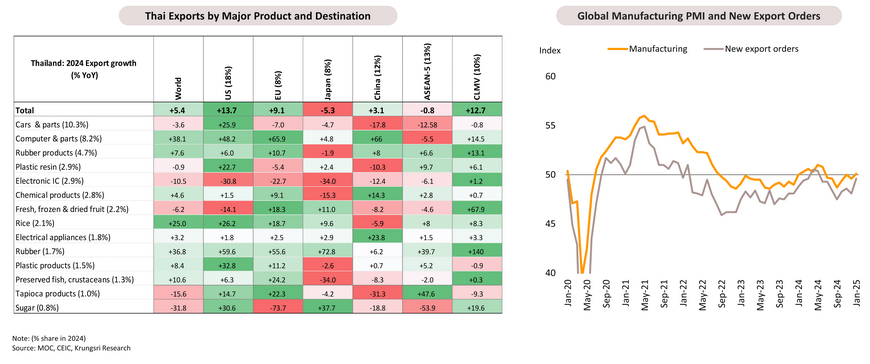

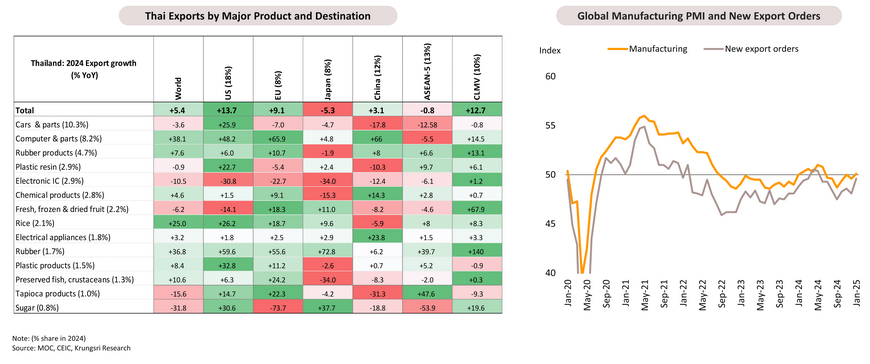

In 2024, Thai exports grew 5.4% YoY (based on MOC data), led by agricultural products, which expanded by 7.5% (including rubber and rice), agro-industrial products (canned & processed seafood and pet food), which expanded by 4.1%, and industrial products (computers & components, rubber products, chemical products, and electrical appliances), which expanded by 5.9%. However, exports of key industrial goods continued to contract, including cars & parts, integrated circuits, and plastic resin. Weak global manufacturing activity and Trump 2.0 uncertainty could hurt Thai exports.

Thailand faces risk of US tariff hikes due to its large trade surplus with the US

In 2023, the US had the largest trade deficit with China at USD 300 bn, followed by Mexico, Vietnam, Germany, and Canada. Thailand ranked 12th overall and 2nd in ASEAN, after Vietnam. After Donald Trump took office as President, he announced a 10% tariff increase on all imported goods from China, effective February 4. In response, China imposed a 10% tariff on US crude oil, agricultural machinery, and certain vehicles, and a 15% tariff on coal and liquefied natural gas (LNG), effective February 10 onward.

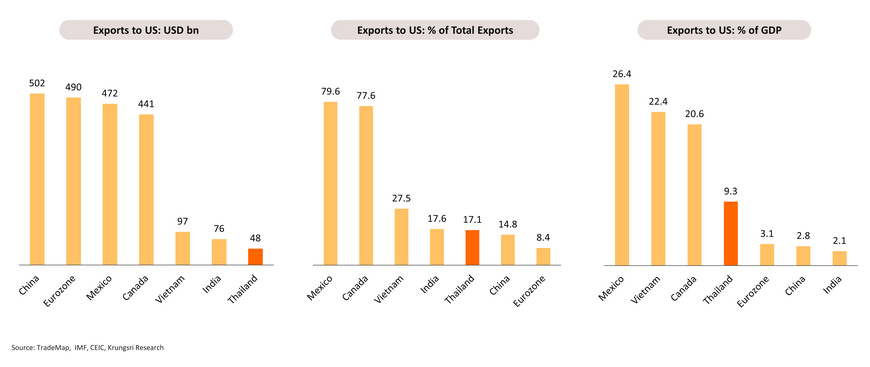

US tariff impact on trading partners’ exports and economies

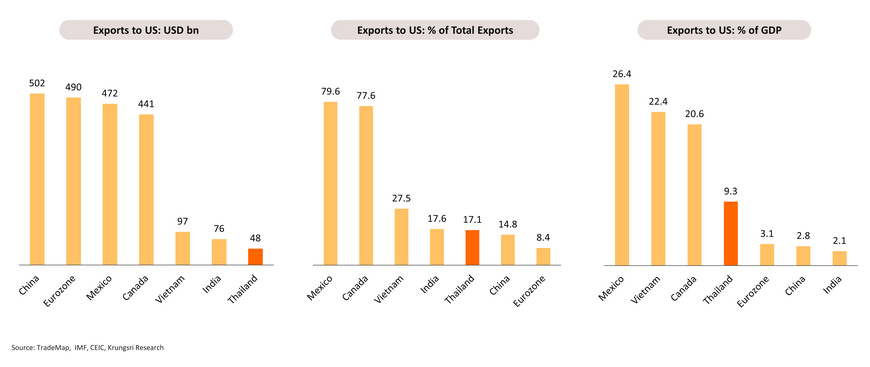

In the early stages, the US may impose tariffs on major countries with the objective of generating revenue from those with large export values to the US, including China (USD 502 bn), the Eurozone (USD 490 bn), Mexico (USD 472 bn), and Canada (USD 441 bn). In the case of the US imposing tariffs on all countries, the largest impact on exports would be seen in Mexico (exports to the US accounting for 79.6% of its total exports) and Canada (77.6%), with moderate impacts on Vietnam (27.5%), Thailand (17.1%), China (14.8%), and the Eurozone (8.4%). The largest impact on GDP would be seen in Mexico (exports to the US accounting for 26.4% of its GDP), Vietnam (22.4%), and Canada (20.6%), followed by Thailand (9.3%), the Eurozone (3.1%), and China (2.8%).

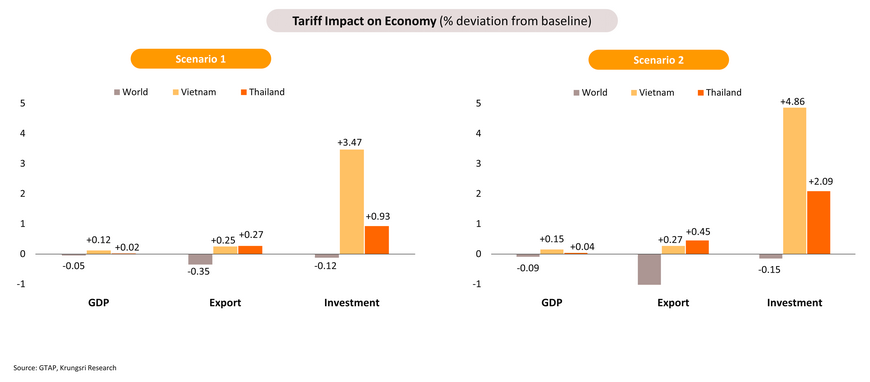

Trump’s recent tariff plans could have a net negative impact on global exports and the economy, despite a small positive impact on some countries

Scenario 1: US imposes 10% tariffs on all Chinese goods and China retaliates with 10-15% tariffs on some US goods.

Scenario 2: Scenario 1 plus US imposing 25% tariffs on all imports from Canada and Mexico.

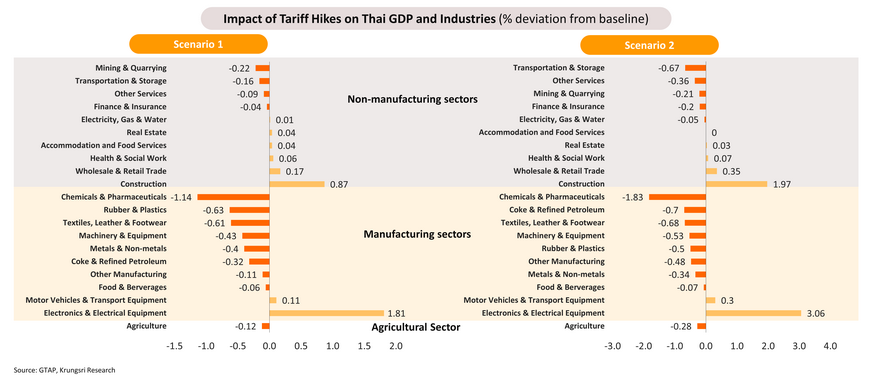

Trump’s recent tariff plans: Positive impact on Thailand is limited to only some specific industries, but many industries could suffer from tariff hikes

Scenario 1: US imposes 10% tariffs on all Chinese goods and China retaliates with 10-15% tariffs on some US goods.

Scenario 2: Scenario 1 plus US imposing 25% tariffs on all imports from Canada and Mexico.

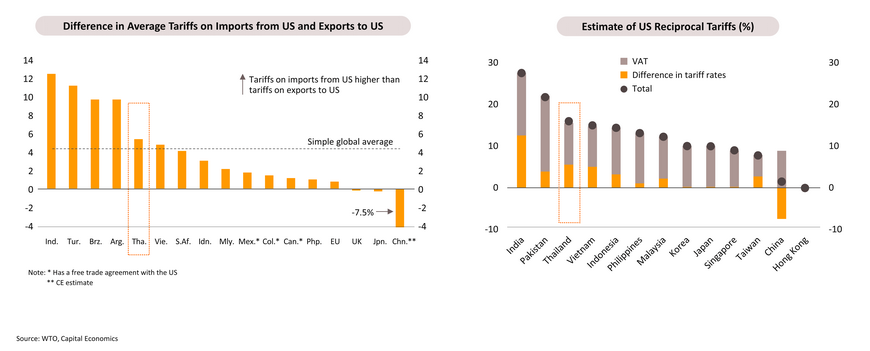

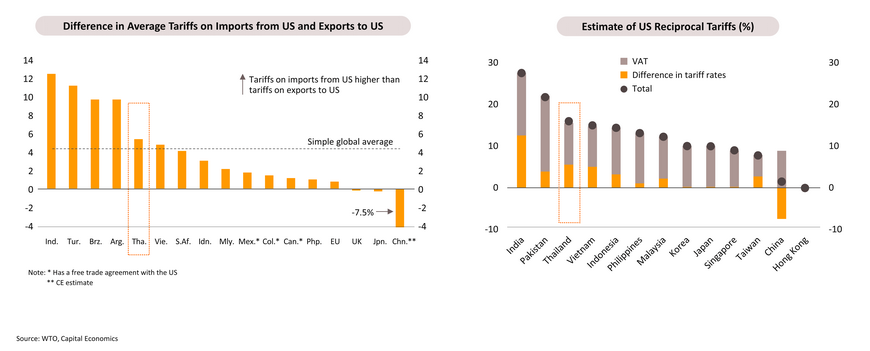

Thailand among countries at risk from US reciprocal tariffs, may see most impact in ASEAN

If the Trump administration pursues a reciprocal tariff strategy, emerging markets would experience a greater loss in competitiveness, according to Capital Economics' analysis. India, Turkey, and Brazil would be among the most impacted, due to having the largest gaps in bilateral tariffs with the US. Following them, Thailand and Vietnam would also be affected, as their tariff gaps exceed the global average. Based on a simple calculation that combines VAT rates and differences in tariff rates, Thailand emerges as the hardest-hit country in ASEAN under a new tariff regime, followed by Vietnam, Indonesia, and the Philippines.

1Q25 inflation may stay within target, with yearly average near its lower bound, opening door for rate cut to 2.0% this year

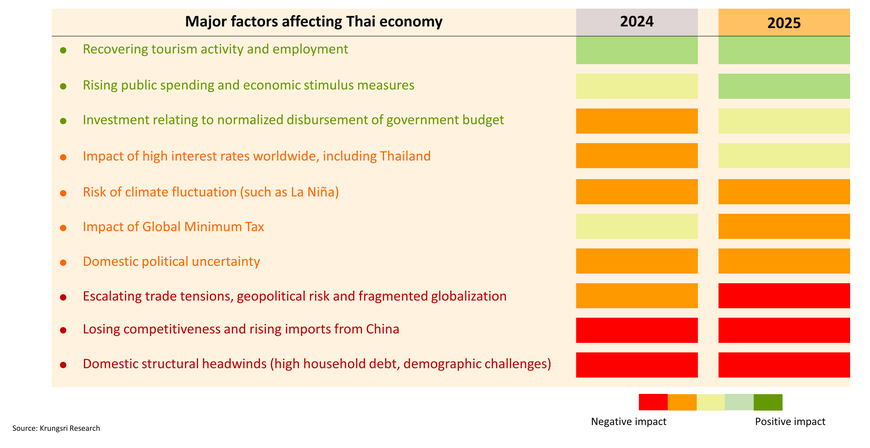

Key factors in 2025: Growth to pick up only slightly with limited stimulus impacts, slow tourism recovery, structural headwinds and external risks