Global: Learning to live with the “new normal”

There are threats to global growth but they will not derail recovery; daily COVID-19 cases are plateauing

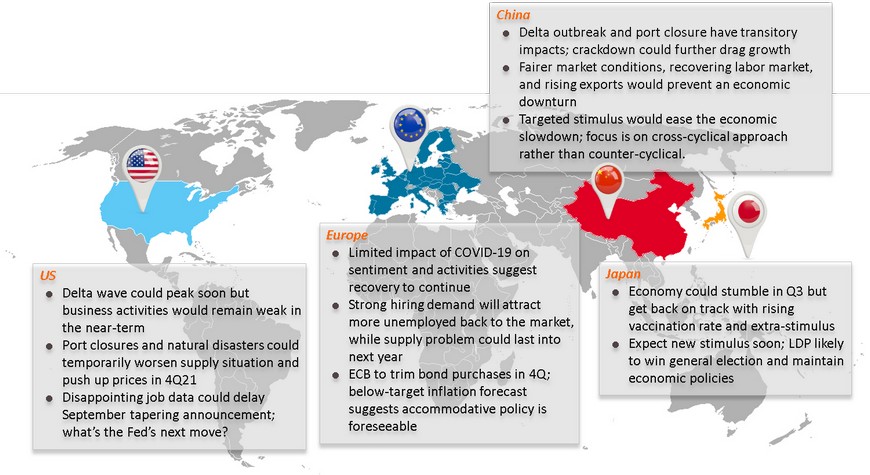

Rising daily COVID-19 cases, containment measures, and public caution, have caused a slowdown in economic activity, particularly in the services sector. Also, post-reopening pent-up demand has softened. However, Services PMIs in the US and Eurozone remain strong and above their pre-pandemic levels. Manufacturing PMIs in the US, Eurozone and Japan continued to expanded favorably. The gradual relaxation of containment measures in China should improve economic activity in the period ahead. Meanwhile, the WHO has said global daily COVID-19 cases are plateauing. In addition, global COVID-19 fatality rate is also dropping with rising vaccination rate and a larger population with natural immunity. Despite the slowdown, the global economy, led by advanced countries, is expected to continue to recover given large policy supports and increasing adaptability to the new normal.

US: Delta wave could peak soon but business activities would remain weak in the near-term

The large cumulative number of cases which create natural immunity, coupled with 60% vaccination rate, suggest daily cases would peak soon. Despite higher utilization of ICU beds, daily cases have been slowing since the beginning of September and fatalities remain low. The Delta wave threatens to dampen spending and consumer confidence as Americans get increasingly concerned about the health of the economy. The Consumer Confidence Index fell to a 6-month low of 113.8 in August. High-frequency data reflect softer activities. The number of airline passengers dropped to 1.76 million in late-August from over 2.0 million in the previous month. However, latest data indicate a smaller impact on economic activities than previous outbreaks. Retail and grocery activities have slowed down but remain on a steady growth path. Personal spending growth missed consensus estimate, at +0.3% MoM in July, but the services sector continued to climb back led by food and accommodation. Spending on goods remain above pre-pandemic level. Looking ahead, back-to-school demand in September could nudge up consumption in late-3Q. However, fading fiscal stimulus and public caution following the Delta wave would weigh on private consumption and rein in economic growth in 4Q21.

Port closures and disaster could temporarily worsen supply situation and push up prices in 4Q21

Manufacturing PMI rose in August led by recovering demand, but there are lingering supply problems. The backlog sub-index has been rising mainly due to a shortage of materials and skilled-labor, delivery delays, and capacity constraints, which continue to feed on inflationary pressure. Overall prices are expected to rise further in 4Q due to temporary risks. There could be spillover effects from closure of China ports as container ships waiting to berth hit record-high, threatening greater delays to transportation. Hurricane Ida made landfall and caused electricity shortage, halting operations at 12% of oil refinery capacity nationwide. These temporary risks could lift cost of materials and gasoline prices from late-3Q before easing in November. However, the lingering supply problem would keep inflation above 3% as vehicles and gasoline prices contributed the largest share. Rising concerns over inflation and softer growth suggest the government might offer additional stimulus to encourage job creation and lift income expectations. The House aims to pass the USD550bn infrastructure bill by October but has not decided on the financing method. It could be a combination of trimming non-essential expenses and increasing borrowings. Even so, that could lead to substantial gains in real GDP in the longer-term. To conclude, the supply disruption would continue to weigh on prices while the additional bill could help to bolster consumer sentiment, but we have yet to see positive impact on GDP.

Disappointing job data could delay September tapering announcement; what’s the Fed’s next move?

There are clear signals the Fed is shifting gear after Powell’s speech at Jackson Hole. He said it might be appropriate to start reducing the pace of asset purchases this year but they will not rush to hike rates. Although commodity prices and inflation expectations keep rising, the sharp decline in August non-farm payrolls, especially hospitality hiring, suggests the latest outbreak has hurt the job market. This report could delay tapering announcement to November, instead of September. However, the economy has registered a solid recovery since 1H21, suggesting tapering could start in December. They might reduce asset purchases to USD15-20bn per month, which could take the central bank 6-8 months to complete (i.e. by 2H22), based on USD120bn monthly bond purchases currently. The 2013 Taper Tantrum is unlikely to recur thanks to the Fed’s constant communication and credibility. There was good response from financial markets; the S&P 500 Index has continued to rise and 10-year yield has dropped after the clear tapering signal. But the question is when the Fed will start to hike rates. Surveys indicate much higher probability of a rate hike decision at the September and December 2022 meetings. We estimate the first rate hike could be as early as 4Q22 to ensure a seamless transition to a tightening policy.

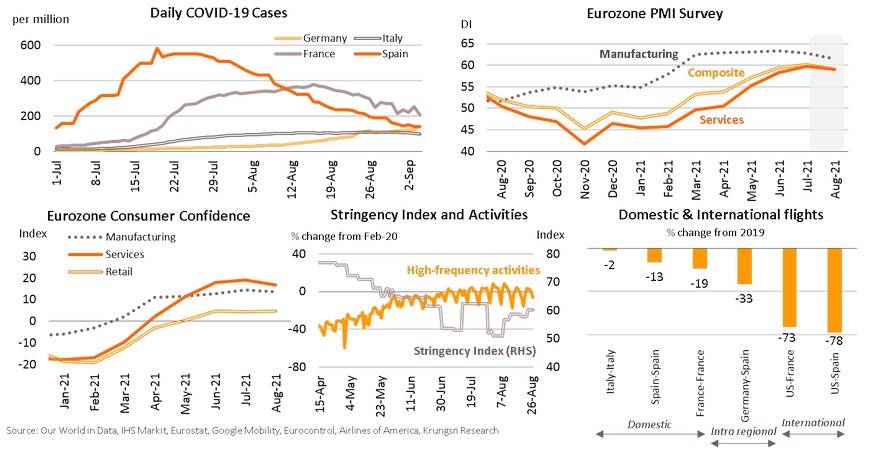

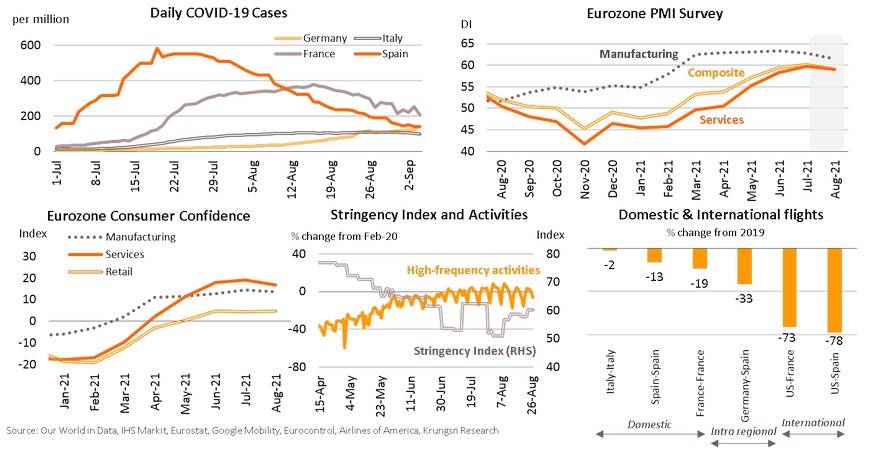

EU: Limited impact of COVID-19 on sentiment and activities suggest economic recovery to continue

Daily cases in France and Spain have dropped to the lowest since July. New cases in Germany and Italy have started to slow down as over 70% of the adult population has been vaccinated. The EU authorities are considering giving booster shots to prevent the spread of the new variant. Latest Delta spike slightly affected the sentiment and economic activities compared to other developed countries. The Eurozone Composite PMI slid to 59 in August from 60.2 the month before. Manufacturing is stable compared to July, despite supply disruptions. On the services side, concerns over the delta variant and fading reopening effects pushed down Services PMI and dampened consumer confidence. However, high-frequency data reflect improvements in ongoing activities due to easing social restrictions. In travel, the number of domestic and intra-regional flights picked-up to 10-30% below 2019-level. EU airlines were forced to push back flights to the US because of rising daily COVID-19 cases rather than travel regulations. This would temporarily freeze the recovery in air travel between regions. Although tourism activities remained weak, relatively smaller impact from the delta variant than previous waves, as well as steady consumer demand, suggest the economy is on track to head into a sustainable recovery from 4Q21.

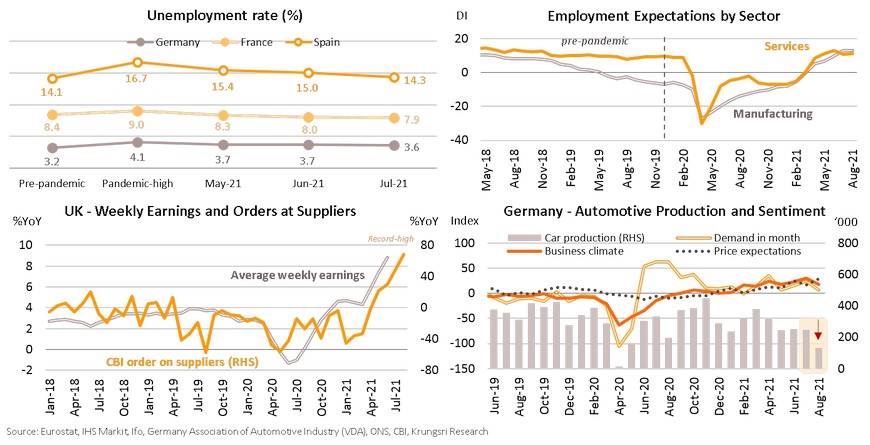

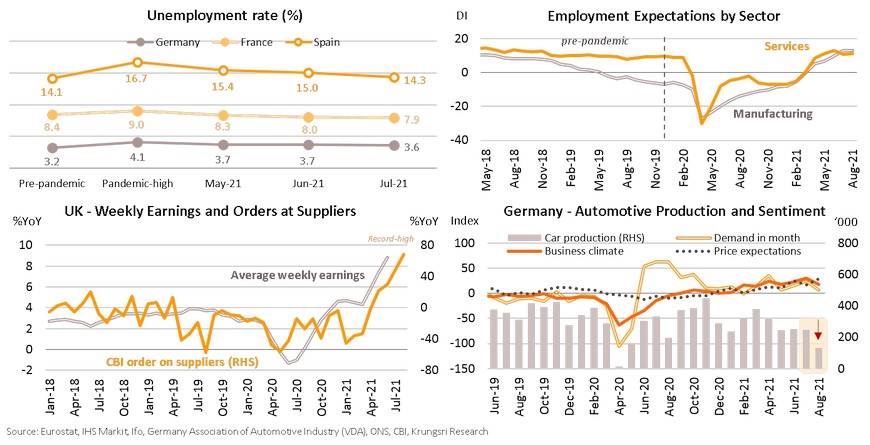

Strong hiring demand will attract unemployed back to the market, while supply problem could last into next year

The Eurozone recovery is driven by resilient consumer spending, as demand for goods and services have surged since reopening. Unemployment rate has been falling below the region’s pandemic-high but businesses are experiencing labor shortage, which could send the job market into lower gear. Companies cited skills mismatch as a major problem and longer training process. However, employment expectations in both the manufacturing and services sectors remain near record highs, suggesting still-strong demand for workers and unemployed workers would eventually return. In the UK, labor shortage is more pronounced than in Eurozone and could persist for up to 2 years post-Brexit. This could drive up wages to 10% above last year’s level could hinder the recovery. Supply disruptions have hurt industry performance, especially automotive industry as Germany’s car output had tumbled in August. Manufacturers reported more solid demand and business sentiment than pre-pandemic levels, but are still struggling with a shortage of chips & components, and expect the impact to last until 2022. In addition, China port disruptions created temporary chaos in prices due to congestion in inbound freight in the EU. The combined temporary and extended supply disruptions could cause inflation to exceed the ECB’s target for 2021.

ECB to trim bond purchases in 4Q; below-target inflation forecast suggests accommodative policy is foreseeable

Eurozone inflation rose to a decade-high of 3% YoY in August led by energy price and effects of VAT cut in Germany last year. Inflation could remain high in 4Q due to firm energy prices and the recovery in the services sector. Hotel room rates in Spain has been climbing up since reopening in April. Higher demand in winter could push up energy prices ahead. However, as this surge would be driven by temporary factors, the central bank expects the upswing in inflation to ease next year. Inflation forecasts have been nudged up but could rest at 1.5% in 2023. Despite concerns the resurgence in COVID-19 cases in several countries could derail recovery, the ECB said the economic rebound is ‘increasingly advanced’, prompting them to revise up economic growth to 5.0% this year. Following the impressive recovery, the ECB decided to slow monthly pandemic-bond purchases to a ‘moderately lower pace’ than EUR80bn in 2Q-3Q this year. The purchasing pace could possibly drop to EUR60-70bn in 4Q, close to 1Q21-level. However, the ECB’s latest move might not be a tapering move because they have pledged to keep the PEPP program up to March 2022 and other measures are unchanged. Looking ahead, they might consider at the December meeting when to end emergency support and might announce the rotation to the Asset Purchase Program (APP). This would ensure favorable financial conditions and sufficient liquidity in the economy. The ECB’s more dovish policy stance than the Fed, and relatively low medium-term inflation suggest the policymakers need to maintain accommodative policy to achieve the 2%-inflation target.

China: Delta outbreak and port closure have transitory impacts; crackdown could further drag growth

The Chinese economy shows more signs of slowdown in Q3 due to pressures ranged from a prolonged regulatory crackdown and short-term factors, including the recent Delta-driven outbreak and temporary port closure. In August, the Official Composite PMI slipped to 48.9, its lowest since February 2020. Both the Composite and Services PMI dropped into the contraction territory for the first time in 19 months, while the Manufacturing PMI weakened for the 5th consecutive month. The clampdown to narrow wealth gap and curb speculation in real estate and trading of listed companies in stock markets resulted in a plunging equity prices, especially real estate, retail and technology. In fact, regulatory tightening to facilitate fair competition has been limited to information technology, construction and real estate sectors, which account around 18.2% of GDP. The restrictions have already hit real estate transaction, falling for 5 straight months. As for the effects of Ningbo-Zhoushan port closures, the July container throughput dropped to the lowest since May as congestion in marine traffic worsened. However, short-term headwinds begin to ease due to (i) the resumption of port operation from 25 August onwards, which would soften shipping stress, and (ii) the improvement of COVID-19 situation as daily new infections recently reached the lowest since July. Though positive signs from easing outbreak and marine transport disruption, there would not be enough to offset the adverse impact of ongoing regulatory crackdown.

Fairer market condition, improving labor market and growing exports would prevent an economic downturn

Despite the risks that hinder growth, China’s recovery path is not likely to be derailed. Although regulatory crackdown has affected businesses in the real estate and technology sectors, a more-fair competition following monopoly restriction creates more opportunities for local manufacturers and smaller traders. The midstream industries, which partly supply intermediate materials to other domestic manufacturers such as metal and chemical products, as well as labor-intensive industries, including textile and furniture, have started to earn more profits. In addition, the Euromonitor reported that local entrepreneurs who compete with large scale corporations are gaining more market share. Some startups are able to raise more fund to compete with market leaders as equity clamping down shift investors’ interest towards smaller firms. Another improvement has seen in labor market as the average weekly working time reached its 4-year high in July, reflecting a tightening condition that would push up wages and raise purchasing power. On the external front, August’s exports recorded historical high, staying on the expansionary territory for the 13th straight month despite logistics bottlenecks. Overall, the Chinese economy would continue to grow due mainly to the following supporting factors: (i) more competitive markets which provide more opportunities for small businesses, (ii) labor market improvement that helps raise wage income, and (iii) further expansion of exports which would cushion a slowdown of domestic economy.

Targeted stimulus to ease economic slowdown; focus is on cross-cyclical approach rather than counter-cyclical

To alleviate adverse impacts from outbreak, seaport bottleneck and regulatory clampdown, Chinese authorities step up fiscal and monetary measures. During May to July, the monthly value of local government bond issuance mainly used for infrastructure investment were above the monthly average over last year. In terms of monetary policy measures, the People’s Bank of China (PBOC) recently prepared to employ additional targeted monetary easing measures through providing CNY300bn relending facility as a way of encouraging commercial banks to increase lending for SMEs, rural businesses and agricultural sectors. Chinese Premier Xi intends to start his 3rd term in 2022 with a “common prosperity” vision - a moderate prosperity for all. The government has just launched a “cross-cyclical” approach which means “taking action sooner, in a smaller steps and with a longer-term time frame in mind”. It differs from a “counter-cyclical” approach which typically refers to larger-scale measures taken against the current direction of economic cycle. Despite a possible economic slowdown, the targeted monetary and fiscal stimulus for vulnerable groups would mitigate negative impacts on the economy in the short term. Meanwhile, measures to promote competition and reduce inequality would eventually raise income of SMEs and households and thus support economic growth in the longer term.

Japan: Economy could stumble in Q3 but get back on track with rising vaccination rate and extra-stimulus

Japan's economy has been hit by a more severe-than-expected delta-variant outbreak, and economic gains from the Tokyo Olympics held during the state of emergency could be less than expected at JPY1.68trn, or only 3.3% of GDP. The emergence of more-infectious mutant strains has pushed daily caseloads to 26,000, the highest since the pandemic started. In response, the government has extended the state and quasi-state of emergency to 27 prefectures (which together contribute 76% of GDP) until at least 30 September. The prolonged epidemic and stringent measures also caused the Composite PMI to drop to a 1-year low of 45.5 in August, especially because of weaker Services PMI which declined to its weakest since May 2020. In 3Q21, the Japanese economy was pressured by cases dominated by the Delta-strain and more stringent containment measures. From October, the situation is expected to improve, supported by following factors: (i) falling daily cases, partly due to rising vaccination rate (51.1% of the population has been fully-vaccinated). The death toll is also lower than during the previous waves, partly due to rising vaccination rate among the elderly; (ii) positive factors that will continue to support the overall economy, including manufacturing production, driven by the further expansion of major export items and a stronger labor market with more job openings and rising wages. Also, there are government subsidies that enabled work-sharing arrangements to reallocate employees from hard-hit businesses; (iii) expect more stimulus measures, as campaign promises for the general election. Hence, these would likely be implemented after a new government takes office in November 2021. The combination of these factors would return the economy back on the recovery path by Q4.

Expect new stimulus soon; LDP likely to win general election and maintain economic policies

Japanese Prime Minister Yoshihide Suga has decided to resign and not run in the Liberal Democratic Party (LDP) presidential election. The LDP is scheduled to vote on 29 September. Among the possible contenders, Taro Kono is in pole position given support from Suga and Finance Minister Aso’s faction. In addition, Kono is leading in the Kyodo News poll. On the policy side, Kono will push forward the digital transformation program to revive the economy. Kishida would focus on reducing inequality, while Ishiba wants to shift away from ultra-low interest rate policy. It remains difficult for Takaichi to gain sufficient support. Although whoever is elected the LDP leader will propose new economic stimulus measures, Kono's policies will be the most popular because they include post-COVID revitalization plans. At the upcoming general election (expected to be held during 7-14 November), the LDP is tipped to win because of the following: (i) greater support as they lead in popularity polls (33% vs 7% for CDP - the major opposition party), and (ii) preferable policies; the LDP’s liberalization move is more acceptable than the opponent’s socialist approach. Looking ahead, there would be post-election stimulus to boost economic recovery from Q4 onwards. Moreover, Kono leading LDP would be positive for the Japanese economy because he can continue to accelerate vaccination rollout and expedite the use of innovation to boost the economy, despite possible difficulty in conducting reforms and effectively implementing policies.

Thailand: Uncertainties remain high even as COVID-19 cases drop

Daily COVID-19 cases in Thailand have peaked, but remain cautious of lockdown easing

- There are lingering concerns and high uncertainties over the outbreak in Thailand as restrictions are gradually lifted. In our base case scenario, mass vaccination in the next few months should curb daily cases when containment measures are relaxed. Daily cases have peaked but will drop slowly the rest of the year. We expect about 2,500 cases and 40 deaths daily by the end of this year. So, non-pharmaceutical interventions (NPIs) should be relaxed step-by-step. The lockdown-easing timeline and timely communication with the public are crucial to contain the outbreak.

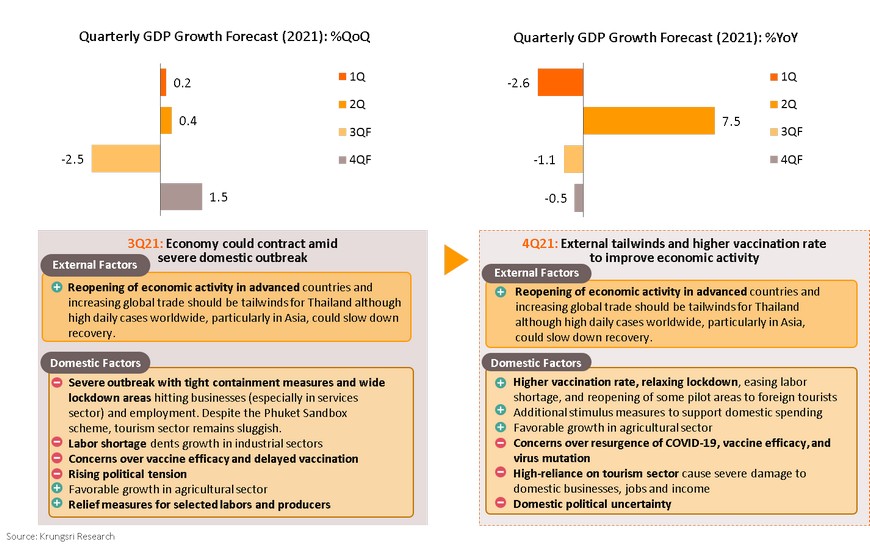

We expect GDP growth to reach only 0.6% this year (instead of 1.2%), reflecting the severe impact of the latest outbreak and spillover effects on the supply side

- The government has eased some containment measures since 1st September but 29 provinces remain under maximum measures. The outbreak and lockdown would have significant impact on businesses and households. Also, the latest outbreak has raised concerns over labor shortage in the industrial sector.

- 2021 GDP growth is projected at 0.6% instead of 1.2%. We revised down 2021F foreign tourist arrivals to 150,000 (from 210,000). We also trimmed growth forecast for private consumption and private investment for this year following weaker business conditions and higher unemployment. For exports, despite gains from a further recovery in the global economy, the impact of the domestic outbreak would limit Thai export growth. So, we maintain 2021 export growth forecast at 15% based on BOT data (based on MOC data, it is 13.5%).

- In 3Q21, Thai GDP is expected to contract quarter-on-quarter, marking the first negative qoq growth since 2Q20. Although a gradual relaxation of containment measures and higher vaccination rate in Thailand could help to ease domestic headwinds in 4Q21, the Thai economy would see only a mild recovery after, and it would be uneven amid high uncertainties.

MPC likely to maintain rate despite higher probability of rate cut

- Our model suggests there is a 52.7% probability the MPC would cut rates at the 29 September meeting. However, we maintain our view that they will not cut rates because (i) domestic economic activity is set to improve as daily cases have peaked, vaccination rate is accelerating, and we expect containment measures to be relaxed gradually; and (ii) the BOT recently launched additional measures to help borrowers who have been hurt by COVID-19. These targeted measures would be more effective than a reduction in the policy rate which is already low, and would have only marginal benefits for businesses and households that have been hurt by the pandemic.

Thailand Economic Outlook 2021-2022

Daily COVID-19 cases in Thailand have peaked but there are lingering concerns and uncertainties until end-2021

Concerns and uncertainties about COVID-19 infections in Thailand would remain high, at least, until the end of 2021 after restriction measures would be lifted gradually. In our base case scenario, accelerating vaccination rate in the next few months should curb the infection curve when containment measures are relaxed. We assumed an average of 460k doses of vaccine would be dispensed each day and 50% vaccine efficacy against the Delta variant. Our model suggests that daily cases have peaked but will drop slowly the rest of the year. We expect about 2,500 cases and 40 deaths daily by the end of this year. So, non-pharmaceutical interventions (NPIs) should be relaxed in phases but we must remain cautious of easing restrictions the rest of the year. We expect further easing in mid-October when daily fatalities dive below 150. In the worst case, even if Thailand dispenses 90mn doses of vaccines by year-end, daily cases could remain high the rest of the year because of low efficacy and rapid easing of containment measures. In this case, we might see a lockdown again.

Still-stringent measures but the public is adapting to the new normal; stay cautious with next easing

Even if the government has relaxed some restrictions, such as reopening restaurants and shops since early-September, the stringency of containment measures (reflected by the Stringency Index by the University of Oxford) remains high. However, we chose to calculate the “implied stringency index” from our infection model, which indicates actual stringency level. It reveals that people react differently to restrictions each time. And more importantly, there was a strong fear of COVID-19 in 2020 but fears have eased with time. This is also reflected in Google mobility data, which shows domestic social activity has improved significantly, especially in retail & recreation. The difference between the stringency index and implied stringency index is that the former would normally hurt the economy but the latter reduces social mobility and limits the outbreak. Closing these gaps would make containment measures more efficient. To effectively contain the outbreak requires a firm easing timeline and timely communication to the public.

2021 GDP growth at only 0.6% due to extended lockdown, more critical zones, and labor shortage

The worse-than-expected COVID-19 outbreak in Thailand dominated by the Delta variant has led to an extended lockdown, more areas being designated critical zones, and labor shortage in industrial sectors. These are estimated to reduce Thai GDP growth by -2.9 ppt. We had priced-in -2.0 ppt impact on GDP growth in our previous forecast in mid-July. Hence, the additional negative impact on our 2021 GDP growth forecast would be -0.9 ppt. On a positive note, we expect the government to introduce more stimulus measures worth THB50bn this year which could add 0.3 ppt to our GDP growth forecast. All in, the net impact on Thai GDP growth would be -0.6 ppt, taking our 2021 full-year growth projection to only 0.6% vs 1.2% previously. We also revised down 2021F foreign tourist arrivals and trimmed private consumption and private investment growth forecasts. However, we maintain our export growth forecast given rising external demand.

Despite Phuket Sandbox scheme, we trimmed 2021F foreign tourist arrivals to 150,000

Pandemic to hit spending; private consumption projected to inch-up 0.5% and investment by 3.7% in 2021

The recent outbreaks and strict control measures in several areas have dampened economic activity and reduced household income and consumer confidence. Current government measures might not sufficient to boost purchasing power. In July, the Private Consumption Index (PCI) registered the largest contraction since April 2020, at -5.3% MoM sa. There were declines in all categories. Private Investment Index (PII) slipped 3.8% MoM sa in July as a result of weaker demand and business sentiment, and the impact of stricter containment measures for construction sites. These have undermined consumer confidence and business sentiment. Business closures and lower employment also dampened domestic economic activity. We revised down 2021 growth forecasts for private consumption and private investment to +0.5% and +3.7%, from +1.1% and +3.9%, respectively.

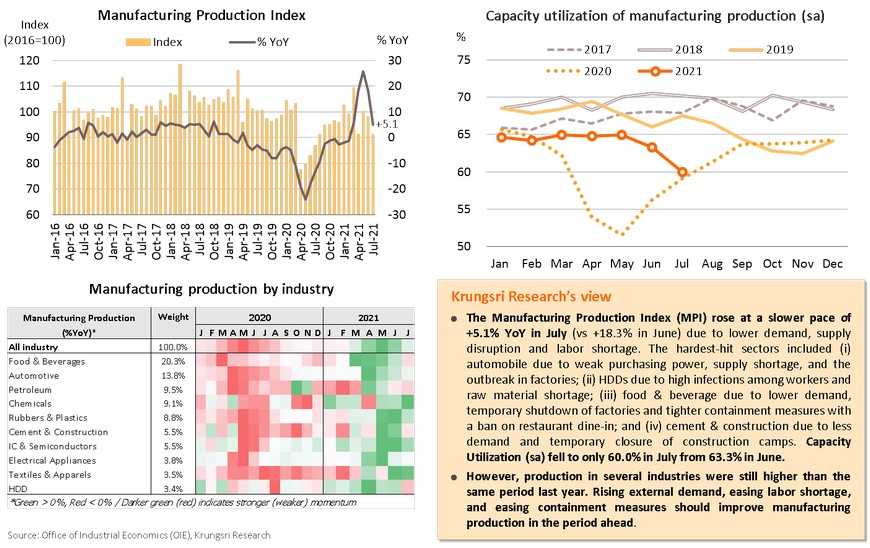

Latest outbreak has affected manufacturing production but there is still support from exports

Export sector remains a key driver of economy, backed by rising external demand and reopening in many countries

Thai export value still higher than before, with positive signals from Asian exporting countries

Even though Thailand’s export value fell to USD22.7bn in July from USD23.7bn in June, it remained well above the last 5-years’ July average of only USD19.3bn. Out of Thailand’s top 20 export products (64.8% of total exports), export values for 17 products (60.4% of total exports) exceeded their pre-COVID levels, led by fresh, frozen & dried fruit, copper, tapioca products, chemical products, and rubber. In addition, global Manufacturing PMI data for major countries remained in an expansion zone and Asia’s exporting countries showed impressive export growth. These are positive signs for Thai exports ahead.

Gradual relaxation of containment measures could support economic activity and sentiment in the period ahead

Economic activity has improved since daily cases started to drop and authorities eased containment measures since 1 September. Google Mobility Index, especially in retail and recreation sectors and grocery & pharmacy, rebounded. Although Thai industries Sentiment Index (TISI) fell for the fifth consecutive month to a 15-month low of 78.9 in August, the expected TISI (next 3 months) rose for the first time in 3 months to 90.9 from 89.3 in July. In addition, FETCO Investor Confidence Index for 3-months-ahead soared to 144.37 (bullish zone) in August from 64.37 (bearish zone) in July, and foreign investors were net buyers of Thai stocks for the first time in 8 months.

150mn doses of vaccines this year; accelerating vaccination in pilot provinces to prepare for reopening

Under the COVID-19 vaccination procurement plan, Thailand is expected to procure more than 15 mn doses of three main vaccines in September. In 4Q21, it would increase to 23-24 mn doses per month. And, alternative vaccines will be procured by the private sector. Overall, a total of 150 mn doses of vaccines is expected to be delivered this year. As of 13 September, 27.5mn persons nationwide had received the first dose (41.0% of population) and 12.8 mn received the second dose (19.1% of population). Phuket recorded the highest number of fully-vaccinated persons (70%) under the Phuket Sandbox program. Bangkok reported the largest share of persons who had received the first dose, but only 36.1% had received the second dose. The government plans to start Phase II of the reopening on 1 October in the following 5 provinces – Bangkok, Chiang Mai (5 districts: Muang, Mae Rim, Mae Tang, and Doi Tao), Prachuab Kirikhan (Hua Hin), Petchburi (Cha Um), Chonburi (Pattaya, Muang district and Sattahip).

Thai economy could contract in 3Q21 but could see mild and uneven recovery in 4Q21 amid uncertainties

Trimmed 2021 inflation forecast due to weaker demand and extended government relief measures

MPC likely to maintain rate as authorities lean towards targeted measures rather than a policy rate cut

Krungsri Research’s model based on MPC meeting result suggests there is a 52.7 % probability of a rate cut at the 29 September meeting. However, we maintain our view that the MPC would keep its policy rate at 0.50% as (i) domestic economic activity will improve as daily cases continue to drop along with higher vaccination rate and lockdown measures have been eased; and (ii) the BOT recently launched additional measures to help COVID-19-affected debtors (a) to maintain and provide new liquidity to SMEs and retail debtors; and (b) make existing debt restructuring facilities more sustainable. These measures, which took effect on September 3, indicates the BOT is leaning towards targeted monetary and financial programs rather than cutting policy interest rates which are already low and there would have only marginal benefits for businesses and households that are hurt by COVID-19.